Bond ladders offer a strategic way to manage investments. They help spread risk and ensure steady income.

Understanding bond ladders starts with grasping the basics of bonds. Bonds are debt securities where you lend money to an issuer for a set time. In return, you get regular interest payments and the principal back at maturity. A bond ladder is a collection of bonds with different maturity dates.

This strategy helps investors manage interest rate risk and liquidity needs. By staggering maturity dates, you can reinvest in new bonds at different rates. This way, you balance the risk and reward over time. Bond ladders are ideal for those seeking predictable income and reduced risk. Ready to learn more? Let’s dive deeper into how bond ladders work.

Credit: www.fidelity.com

Introduction To Bond Ladders

Investing can be complex, but bond ladders simplify it. They help manage risks and returns effectively. This guide will help you understand bond ladders and their benefits.

What Is A Bond Ladder?

A bond ladder is an investment strategy. It involves buying bonds with different maturity dates. Imagine a ladder with steps. Each step represents a bond maturing at a different time.

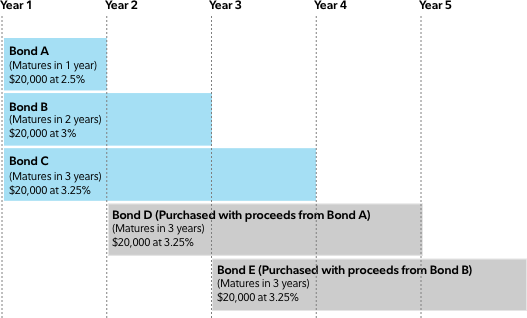

For example, you might buy bonds maturing in 1, 2, 3, 4, and 5 years. As each bond matures, you reinvest the principal in a new bond. This creates a continuous cycle.

This way, you always have bonds maturing at regular intervals. This strategy helps spread out interest rate risk and keeps a steady flow of income.

Purpose Of Bond Ladders

Why use bond ladders? They offer several key benefits:

- Risk Management: Bond ladders reduce interest rate risk. If rates rise, only a part of your portfolio is affected.

- Steady Income: You receive regular income from maturing bonds. This is useful for planning your finances.

- Flexibility: You can adjust your strategy as your needs change. Reinvesting maturing bonds allows flexibility.

Bond ladders also help diversify your investments. By spreading out the maturities, you avoid putting all your money in one bond. This diversification reduces the impact of any single bond defaulting.

In essence, bond ladders create a balanced, predictable, and flexible investment strategy.

Benefits Of Bond Ladders

Bond ladders offer numerous benefits to investors. They provide a structured way to manage investments with reduced risk and predictable income. This approach can be particularly advantageous for those who seek stability and reliable returns.

Risk Mitigation

One of the key benefits of bond ladders is risk mitigation. By spreading investments across bonds with varying maturities, you reduce the impact of interest rate fluctuations. This diversification helps shield your portfolio from sudden market changes.

With a bond ladder, you avoid putting all your money into bonds that mature at the same time. This strategy ensures that not all your investments are exposed to the same risk level. Essentially, it balances your portfolio, making it less vulnerable to market volatility.

Steady Income Stream

Another significant benefit is the steady income stream. A bond ladder provides regular cash flow as bonds mature at different intervals. This staggered maturity schedule means you receive periodic payments, which can be reinvested or used as income.

For example, if you create a bond ladder with bonds maturing every year, you’ll have bonds coming due annually. This approach offers continuous access to funds, enhancing liquidity and financial planning.

| Benefit | Description |

|---|---|

| Risk Mitigation | Reduces impact of interest rate fluctuations. |

| Steady Income Stream | Provides regular cash flow from maturing bonds. |

In summary, bond ladders are an effective investment strategy. They offer risk mitigation and a steady income stream, making them a valuable tool for investors seeking stability and predictability in their portfolios.

Building A Bond Ladder

Creating a bond ladder is a strategic way to manage investments. It involves buying bonds with different maturity dates. This strategy helps spread risk and provides regular income. Let’s dive into how to build a bond ladder.

Choosing Bonds

First, you need to select the right bonds. Look for bonds with different maturity dates. This will ensure your ladder is well-structured. Consider government and corporate bonds. Both have different risk levels and returns. You can also mix short-term and long-term bonds. This mix will balance your portfolio.

Setting Maturity Dates

Next, set the maturity dates for your bonds. Choose dates that spread out over several years. This way, you receive payments at regular intervals. For example, if you have five bonds, space them one year apart. This creates a steady income stream. You can reinvest the money from maturing bonds. This keeps your ladder growing and your income steady.

Here’s a simple table to illustrate:

| Bond | Maturity Date | Interest Rate |

|---|---|---|

| Bond 1 | 2024 | 2.5% |

| Bond 2 | 2025 | 3.0% |

| Bond 3 | 2026 | 3.5% |

| Bond 4 | 2027 | 4.0% |

| Bond 5 | 2028 | 4.5% |

In this example, you receive payments yearly. Reinvesting keeps your ladder strong. A bond ladder is a smart strategy for steady income.

Credit: www.schwab.com

Managing Your Bond Ladder

Creating a bond ladder is only the first step. Managing your bond ladder effectively ensures that it continues to meet your financial goals. This involves reinvesting the proceeds and monitoring the performance of your bonds. Let’s explore these aspects in detail.

Reinvestment Strategy

A key aspect of managing your bond ladder is the reinvestment strategy. When a bond matures, the proceeds should be reinvested to maintain the ladder. Reinvesting helps you keep a steady stream of income.

Consider the following strategies:

- Reinvest in similar bonds: Use the proceeds to buy new bonds with similar maturities.

- Diversify maturities: Spread out maturities to manage interest rate risks.

- Vary bond types: Mix government, municipal, and corporate bonds for better returns.

Reinvesting wisely can help you adapt to changing market conditions and ensure a balanced portfolio.

Monitoring Performance

Regularly monitoring the performance of your bond ladder is crucial. This helps you understand how well your investments are doing and make necessary adjustments.

Here are some steps to follow:

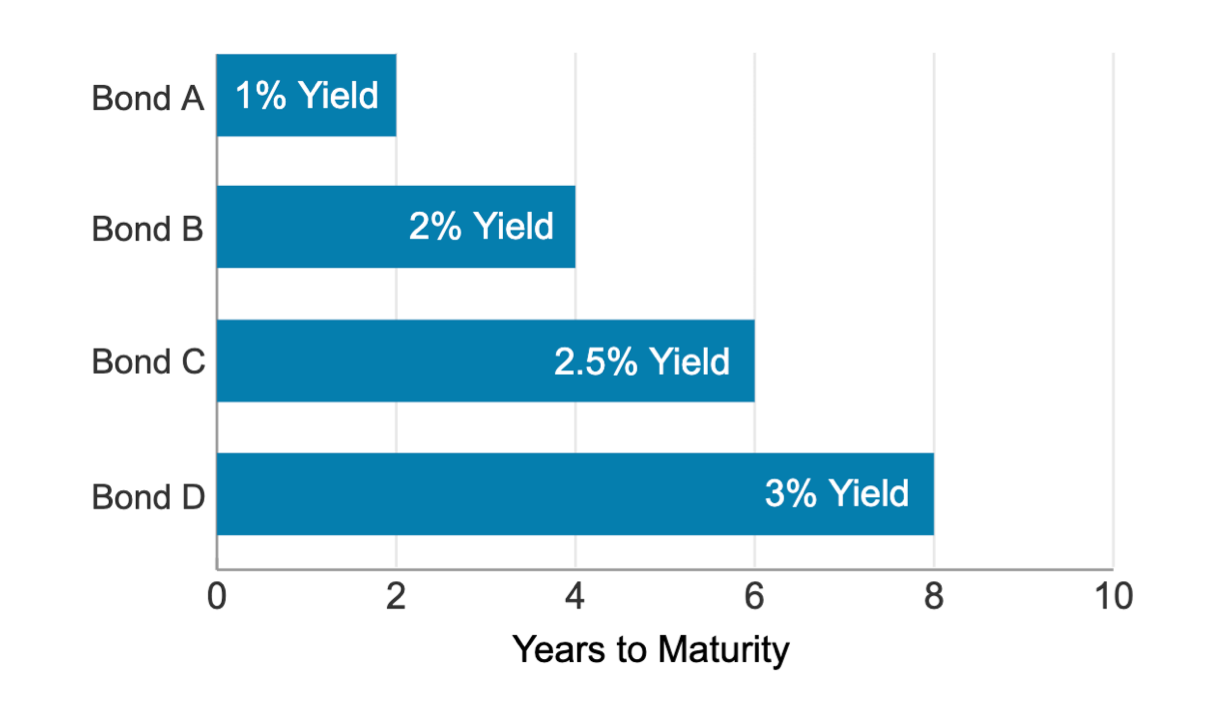

- Track interest rates: Keep an eye on market interest rates. They affect your bond values.

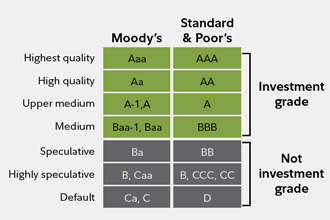

- Check bond ratings: Ensure your bonds maintain a good credit rating.

- Review bond yields: Compare current yields with your goals.

Monitoring helps you stay informed and make proactive adjustments to your investment strategy.

Consider using a table to track your bonds:

| Bond | Maturity Date | Interest Rate | Credit Rating |

|---|---|---|---|

| Bond A | 2025 | 3% | AAA |

| Bond B | 2026 | 4% | AA |

Managing and monitoring your bond ladder ensures your investments remain aligned with your financial objectives.

Comparing Bond Ladders To Other Strategies

When comparing bond ladders to other strategies, it’s crucial to understand their unique benefits. Bond ladders offer a balanced way to manage investments while mitigating interest rate risks. But how do they stack up against other popular methods like bond funds and individual bonds? Let’s delve deeper.

Bond Funds

Bond funds pool money from many investors to buy a variety of bonds. They offer instant diversification and professional management. This can be a plus for those who prefer a hands-off approach.

- Diversification: Bond funds typically hold a large number of bonds, spreading risk.

- Liquidity: Easier to buy and sell compared to individual bonds.

- Management: Professional managers handle the selection and monitoring of bonds.

However, bond funds have some downsides. Fees can eat into returns, and you don’t control the maturity dates. This can be an issue if you need funds at a specific time.

Individual Bonds

Investing in individual bonds means you buy specific bonds directly. This gives you full control over your investment choices.

- Predictable Income: You know the exact interest payments and maturity date.

- Control: You select the bond’s issuer, term, and credit quality.

- No Management Fees: Avoid fees associated with bond funds.

Yet, individual bonds require more effort to manage. You need to research each bond and monitor market conditions. Also, building a diversified portfolio can be costly and complex.

Bond ladders combine the benefits of both strategies. They offer regular income and reduce interest rate risk. Plus, they provide more control than bond funds but require less management than individual bonds.

Maximizing Returns With Bond Ladders

Bond ladders are a strategic way to maximize returns while minimizing risks. This approach involves buying bonds with different maturity dates. By doing so, you create a steady income stream and reduce interest rate risks. Let’s dive into how you can maximize your returns with bond ladders.

Interest Rate Considerations

Interest rates play a crucial role in the performance of bond ladders. When interest rates rise, bond prices usually fall. But with a bond ladder, you can reinvest matured bonds at higher interest rates. This helps you take advantage of rising rates without losing much value on your existing bonds.

Conversely, if interest rates fall, the bonds you hold will likely increase in value. This balance between different interest rate environments helps stabilize your returns. Understanding interest rate trends can help you make better decisions.

Diversification Tips

Diversification is key to reducing risks and maximizing returns. With bond ladders, you can diversify across various sectors and issuers. This helps spread your risk and protect your investments from market volatility. Consider the following tips for effective diversification:

- Issuer Diversification: Invest in bonds from different issuers to avoid concentration risk.

- Sector Diversification: Include bonds from various sectors like government, corporate, and municipal.

- Maturity Diversification: Ensure your bonds have staggered maturity dates to maintain liquidity.

A well-diversified bond ladder can provide a more stable and predictable income stream. This approach can also help you weather market fluctuations more effectively.

Credit: www.fidelity.com

Frequently Asked Questions

What Is A Bond Ladder?

A bond ladder is an investment strategy. It involves buying bonds with different maturity dates.

How Do You Build A Bond Ladder?

Buy bonds with staggered maturity dates. This spreads out your investment over time.

What Are The Benefits Of A Bond Ladder?

A bond ladder offers steady income. It also reduces interest rate risk.

How Does A Bond Ladder Reduce Risk?

It spreads investments over different time periods. This minimizes the impact of interest rate changes.

Can I Use Bond Ladders For Retirement?

Yes, bond ladders provide regular income. They are a good option for retirees.

Conclusion

Bond ladders offer a smart way to manage investments. They provide steady income and reduce risk. By diversifying bonds, you can enjoy more security. Laddering bonds also helps with interest rate changes. Investors can earn regularly and plan better. It’s a simple yet effective strategy.

Start building your bond ladder today. Enjoy peace of mind and financial stability. Happy investing!