A CD ladder is a strategy for saving money. It involves multiple Certificates of Deposit (CDs) with different maturity dates.

This method helps you earn higher interest rates while keeping some funds accessible. CD ladders offer a blend of liquidity and returns. Instead of putting all your money in one CD, you spread it across several. This approach provides better flexibility and higher earnings.

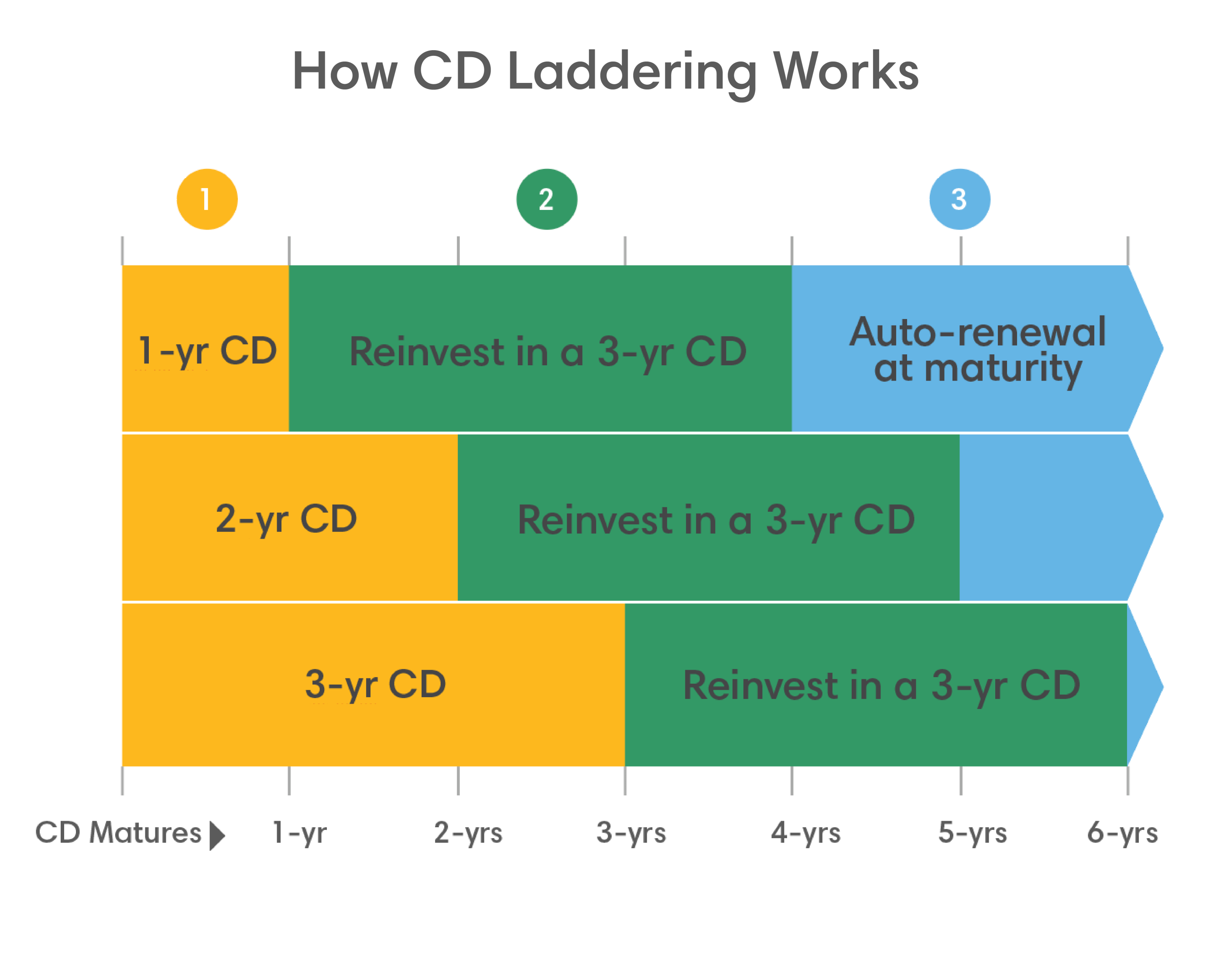

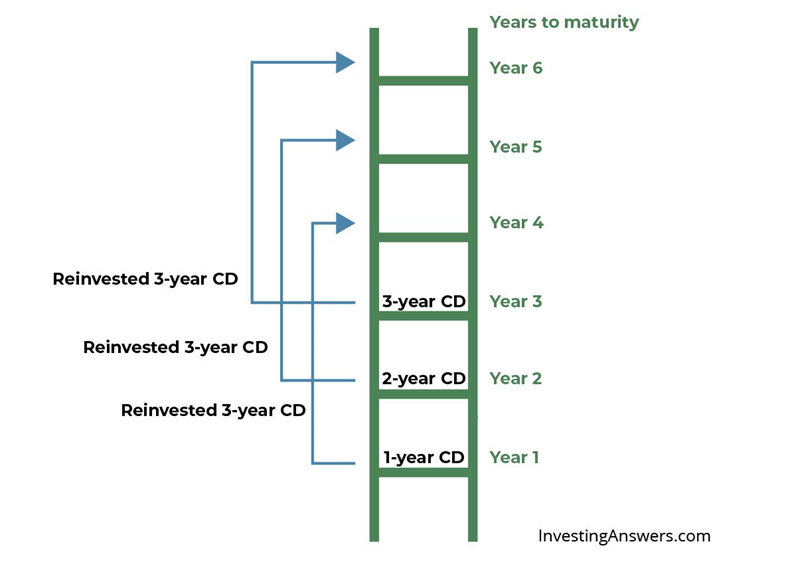

Imagine having a set of CDs that mature at different times. When one CD matures, you can reinvest it in a new one or use the money if needed. This way, you avoid locking all your money for a long time. CD ladders are ideal for those seeking a balanced approach to saving. They offer a structured way to grow your savings with minimal risk.

Introduction To Cd Ladders

Investing can be tricky. CD ladders help to make it easier. These are a smart strategy for those looking to grow their savings. Let’s dive into how CD ladders work.

What Is A Cd Ladder?

A CD ladder is a way to invest in Certificates of Deposit (CDs). Instead of putting all your money in one CD, you divide it among several CDs with different maturities.

For example, you might invest in CDs that mature in 1, 2, 3, 4, and 5 years. This way, you have CDs maturing at different times. This approach helps balance liquidity and interest rates.

Benefits Of Cd Ladders

CD ladders offer many benefits for investors. Here are some key advantages:

- Liquidity: Money is available at regular intervals.

- Higher Interest Rates: Longer-term CDs often offer higher rates.

- Risk Management: Spreading out maturities reduces risk.

- Flexibility: Reinvest or use funds as CDs mature.

Using a CD ladder can make your savings strategy more effective. It balances the need for access and the desire for growth.

Setting Up Your Cd Ladder

Setting up a CD ladder can be a smart way to manage your savings. This strategy helps you take advantage of higher interest rates over time. It also keeps a portion of your money accessible. Here’s a step-by-step guide to get started.

Choosing The Right Term Lengths

First, decide on the term lengths for your CDs. The term length is the time your money is locked in the CD. Shorter terms offer flexibility, while longer terms often have higher interest rates.

Here’s a simple table to illustrate different term lengths and their potential benefits:

| Term Length | Benefits |

|---|---|

| 6 Months | Quick access to funds, lower interest rate |

| 1 Year | Moderate access, higher interest rate than 6 months |

| 2 Years | Less access, even higher interest rate |

| 5 Years | Least access, highest interest rate |

Initial Investment Amount

Next, decide on your initial investment amount. This is the total sum you want to invest in CDs. Divide this amount equally among the CDs.

For example, if you have $10,000 to invest, you could set up a ladder like this:

- $2,500 in a 6-month CD

- $2,500 in a 1-year CD

- $2,500 in a 2-year CD

- $2,500 in a 5-year CD

Each CD matures at different times, giving you regular access to your funds.

Setting up your CD ladder is straightforward. Choose the right term lengths and decide on your initial investment amount. This strategy helps balance growth and accessibility of your savings.

Managing Your Cd Ladder

Creating a CD ladder is a wise investment strategy, but managing it is crucial. Proper management ensures you maximize returns and maintain liquidity. This section will guide you on effective ways to manage your CD ladder.

Reinvestment Strategies

Reinvestment strategies are key to keeping your CD ladder profitable. As each CD matures, you have several options.

- Renew the CD: Roll it over into a new CD with a similar term.

- Reinvest in a different term: Choose a longer or shorter term based on your financial goals.

- Withdraw the funds: Use the money for other investments or expenses.

Consider current interest rates and your financial needs. Adjust your strategy accordingly. For instance, if rates are high, reinvesting in longer terms could be beneficial.

Tracking Your Maturities

Tracking your CD maturities is essential. Missing a maturity date can lead to automatic renewals at less favorable terms. Here’s how to stay on top of it:

- Create a calendar: Use a digital or physical calendar to mark maturity dates.

- Set reminders: Set alerts a few days before each CD matures.

- Use financial tools: Many banks offer tools to help track your investments.

A simple table can also help you keep track of maturities:

| CD Term | Maturity Date | Action |

|---|---|---|

| 1 Year | 01/01/2024 | Reinvest |

| 2 Year | 01/01/2025 | Renew |

Regularly review your CD ladder. Adjust your strategy based on your financial situation and goals. This ensures your CD ladder works efficiently for you.

Credit: www.firstcitizens.com

Maximizing Returns

Maximizing returns with CD ladders requires a strategic approach. You can ensure higher returns while maintaining liquidity. Let’s explore some key considerations.

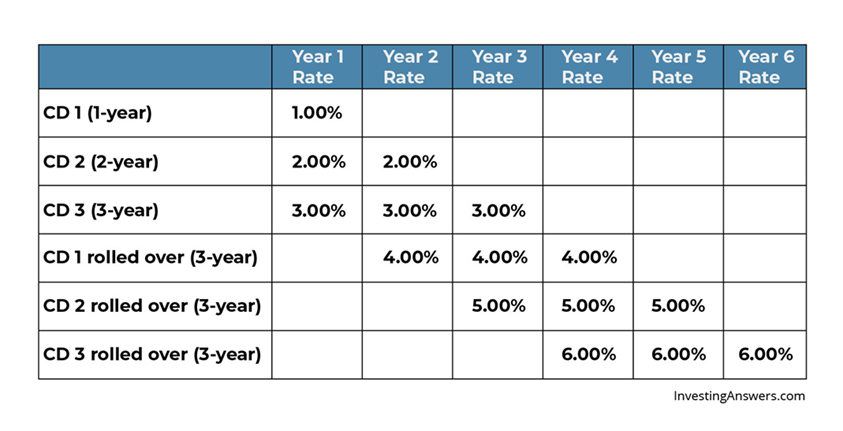

Interest Rate Considerations

Interest rates play a vital role in CD ladders. They determine your earnings. Always look for the best available rates.

Here is a simple table to understand the potential returns:

| CD Term | Interest Rate | Return |

|---|---|---|

| 1 Year | 1.5% | $150 on $10,000 |

| 2 Years | 2.0% | $400 on $10,000 |

| 3 Years | 2.5% | $750 on $10,000 |

As shown, longer terms often offer higher rates. But, you also need liquidity.

Avoiding Penalties

Early withdrawal penalties can reduce your earnings. To avoid this, plan your CD ladder carefully.

Here are a few tips to avoid penalties:

- Stagger your CD maturity dates.

- Only withdraw funds at maturity.

- Keep an emergency fund separate from your CD ladder.

These steps can help you avoid penalties and maximize returns.

By understanding interest rates and avoiding penalties, you can make the most of your CD ladder investments.

Risk Management

CD ladders are a great way to manage risk in your investments. They help you spread out your money across different term lengths. This strategy can protect you from interest rate changes and provide steady returns.

Diversification

Diversification is key in any investment strategy. With a CD ladder, you invest in multiple CDs with different maturity dates. This way, your money is not tied up in one CD for a long time. If interest rates rise, you will have CDs maturing soon to reinvest at higher rates.

| Term Length | Interest Rate |

|---|---|

| 1 Year | 1.5% |

| 2 Years | 2.0% |

| 3 Years | 2.5% |

| 4 Years | 3.0% |

| 5 Years | 3.5% |

Understanding Fdic Insurance

FDIC insurance is an important aspect of CD investments. It protects your money in case the bank fails. Each CD account is insured up to $250,000. This means your principal and interest are safe.

When you use a CD ladder, ensure each CD is with an FDIC-insured bank. This way, even if one bank fails, your other CDs are still protected. This helps to further reduce risk and provides peace of mind.

In summary, managing risk with CD ladders involves diversification and understanding FDIC insurance. These strategies help protect your investments and ensure steady returns.

Credit: www.glcu.org

Alternative Strategies

When considering investment strategies, alternative strategies can provide diverse opportunities. One such strategy involves CD ladders. While CD ladders are a popular choice, there are other methods to explore. Here, we will compare CD ladders with bond ladders and discuss the use of CDs in retirement planning.

Comparing To Bond Ladders

CD ladders and bond ladders share similarities but have distinct differences. Both involve staggering investments over time. This approach reduces risk and ensures a steady income.

| Aspect | CD Ladders | Bond Ladders |

|---|---|---|

| Investment Type | Certificates of Deposit | Bonds |

| Risk Level | Low | Varies |

| Returns | Fixed Interest | Variable Interest |

| Liquidity | Low until Maturity | Higher |

CD ladders usually offer fixed interest rates and lower risk. Bond ladders, on the other hand, can provide higher returns but come with varying risks.

Using Cds In Retirement Planning

CD ladders can play a crucial role in retirement planning. They offer safety and predictable income. This strategy is ideal for those who need stable cash flow during retirement.

Benefits of using CDs in retirement planning include:

- Guaranteed Returns: Fixed interest ensures predictable income.

- Risk Management: Low risk compared to stocks.

- Easy Access: Funds available at each maturity date.

To implement a CD ladder in retirement:

- Divide your investment into equal parts.

- Purchase CDs with different maturity dates.

- Reinvest each matured CD into a new long-term CD.

By following these steps, you can create a reliable income stream for your retirement years.

Credit: www.glcu.org

Frequently Asked Questions

What Is A Cd Ladder?

A CD ladder is an investment strategy. It involves buying multiple CDs with different maturity dates.

How Does A Cd Ladder Work?

You invest in CDs with staggered maturity dates. This provides regular access to your funds.

Why Use A Cd Ladder?

A CD ladder offers better interest rates. It also provides liquidity at regular intervals.

Are Cd Ladders Safe?

Yes, CD ladders are low-risk. They are typically insured by the FDIC.

What Are The Benefits Of A Cd Ladder?

Benefits include higher interest rates and regular access to funds. It also diversifies investment risks.

Conclusion

CD ladders offer a smart way to manage savings. They provide steady interest and minimize risks. By staggering maturity dates, you gain flexibility. This strategy ensures regular access to funds. It helps balance growth and security. Start small, and watch your savings grow.

Explore CD ladders today and see the benefits. Smart savings, made simple.