A CD ladder is a smart savings strategy. It helps you earn more interest with less risk.

CD ladders involve splitting your money into several certificates of deposit (CDs) with different maturity dates. This way, you can take advantage of higher interest rates without locking all your money away for a long time. Each CD in the ladder matures at a different time, giving you regular access to your cash.

It’s a way to balance the need for liquidity with the goal of higher returns. In this blog, you will learn how CD ladders work, the benefits they offer, and how you can set one up to fit your financial goals. Let’s explore this simple yet effective savings tool.

Credit: www.glcu.org

Introduction To Cd Ladders

Investing your money can be tricky. You want safety and growth. One smart way is to use CD ladders. They offer both. Let’s learn what a CD ladder is and its benefits.

What Is A Cd Ladder?

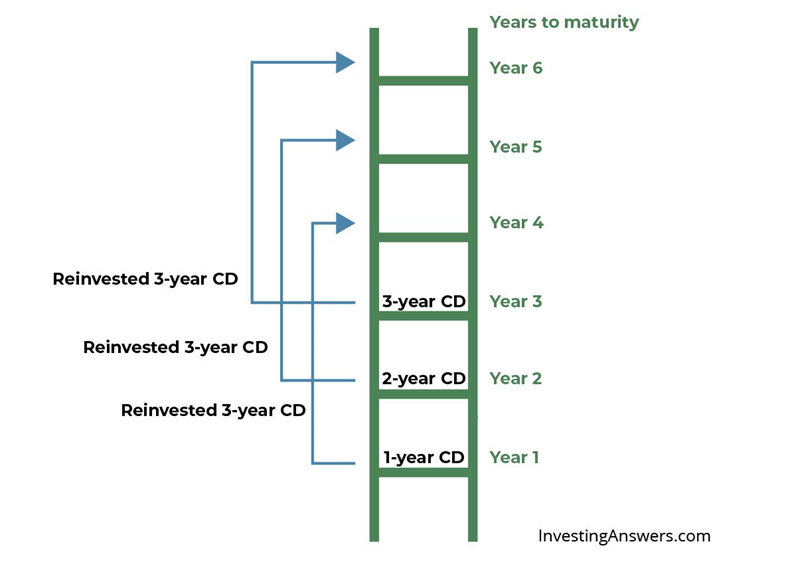

A CD ladder is a series of certificates of deposit (CDs) bought at different times. This way, not all your money is locked up at once. Think of it as a staircase. Each step is a CD maturing at a different time.

For example, you can divide your money into five parts. Invest in CDs maturing in 1, 2, 3, 4, and 5 years. Each year, one CD matures, and you can decide what to do next.

Benefits Of Cd Ladders

CD ladders offer many benefits. Here are the key ones:

- Liquidity: You get access to your money at regular intervals. This makes it easier to plan for future expenses.

- Higher Interest Rates: Longer-term CDs often have higher rates. By laddering, you can benefit from these rates.

- Reduced Interest Rate Risk: Interest rates change. With a ladder, only part of your money is affected at any time.

Let’s break it down into a simple table:

| Year | CD Maturity |

|---|---|

| 1 | 1-year CD |

| 2 | 2-year CD |

| 3 | 3-year CD |

| 4 | 4-year CD |

| 5 | 5-year CD |

Each year, a CD matures. You can reinvest or use the money. It’s flexible and smart.

Building Your Cd Ladder

Building a CD ladder can be a smart way to maximize your savings. It allows you to get higher interest rates while keeping some money available. Below, we will explore how to build your CD ladder step by step.

Choosing The Right Cds

First, you need to choose the right Certificates of Deposit (CDs). Look for banks offering competitive interest rates. Compare different terms, such as 6 months, 1 year, 2 years, and 5 years. Opt for CDs that have no or low early withdrawal penalties. This ensures flexibility if you need to access your money.

Setting Up The Ladder

Setting up your CD ladder involves buying CDs with different maturity dates. This spreads out your investment and reduces risk. Here is how you can do it:

- Divide your total investment amount into equal parts. For example, if you have $5,000, split it into five $1,000 parts.

- Buy one CD for each term. For instance, buy a 1-year CD, a 2-year CD, a 3-year CD, a 4-year CD, and a 5-year CD.

- As each CD matures, reinvest it into a new 5-year CD. This keeps the ladder going and ensures you always have a CD maturing every year.

To illustrate, here is a simple table:

| Investment Amount | CD Term |

|---|---|

| $1,000 | 1 year |

| $1,000 | 2 years |

| $1,000 | 3 years |

| $1,000 | 4 years |

| $1,000 | 5 years |

By following these steps, you can build a CD ladder that maximizes your savings. You will earn more interest and have access to funds regularly.

Maximizing Returns

Understanding how CD ladders work can help you make the most of your investments. A CD ladder is a strategy that involves buying multiple certificates of deposit (CDs) with staggered maturity dates. This approach can help you access better interest rates while keeping some of your money liquid. Let’s explore how to maximize returns with CD ladders.

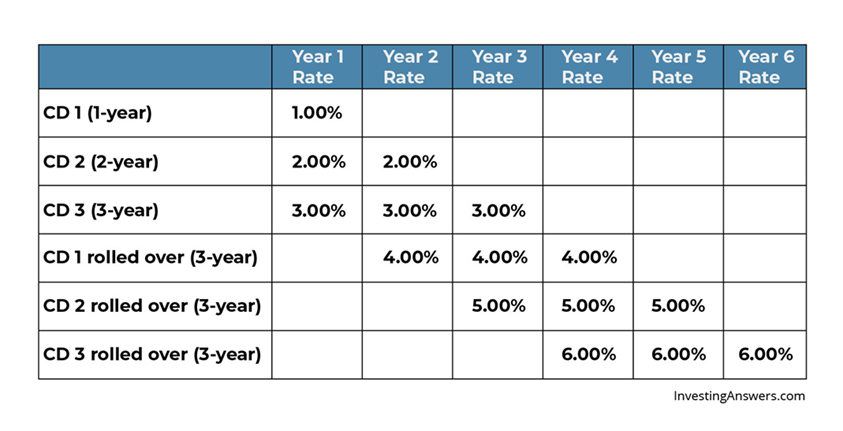

Interest Rates

Interest rates are crucial in determining your returns. CDs with longer terms generally offer higher interest rates. By using a ladder strategy, you can take advantage of these higher rates without locking all your money in long-term CDs. Consider this simple example:

| Term | Interest Rate |

|---|---|

| 1-Year CD | 1.5% |

| 2-Year CD | 2.0% |

| 3-Year CD | 2.5% |

By spreading your investments across these terms, you can earn a higher average interest rate. This strategy ensures that you benefit from the higher rates offered by longer-term CDs.

Reinvesting Strategies

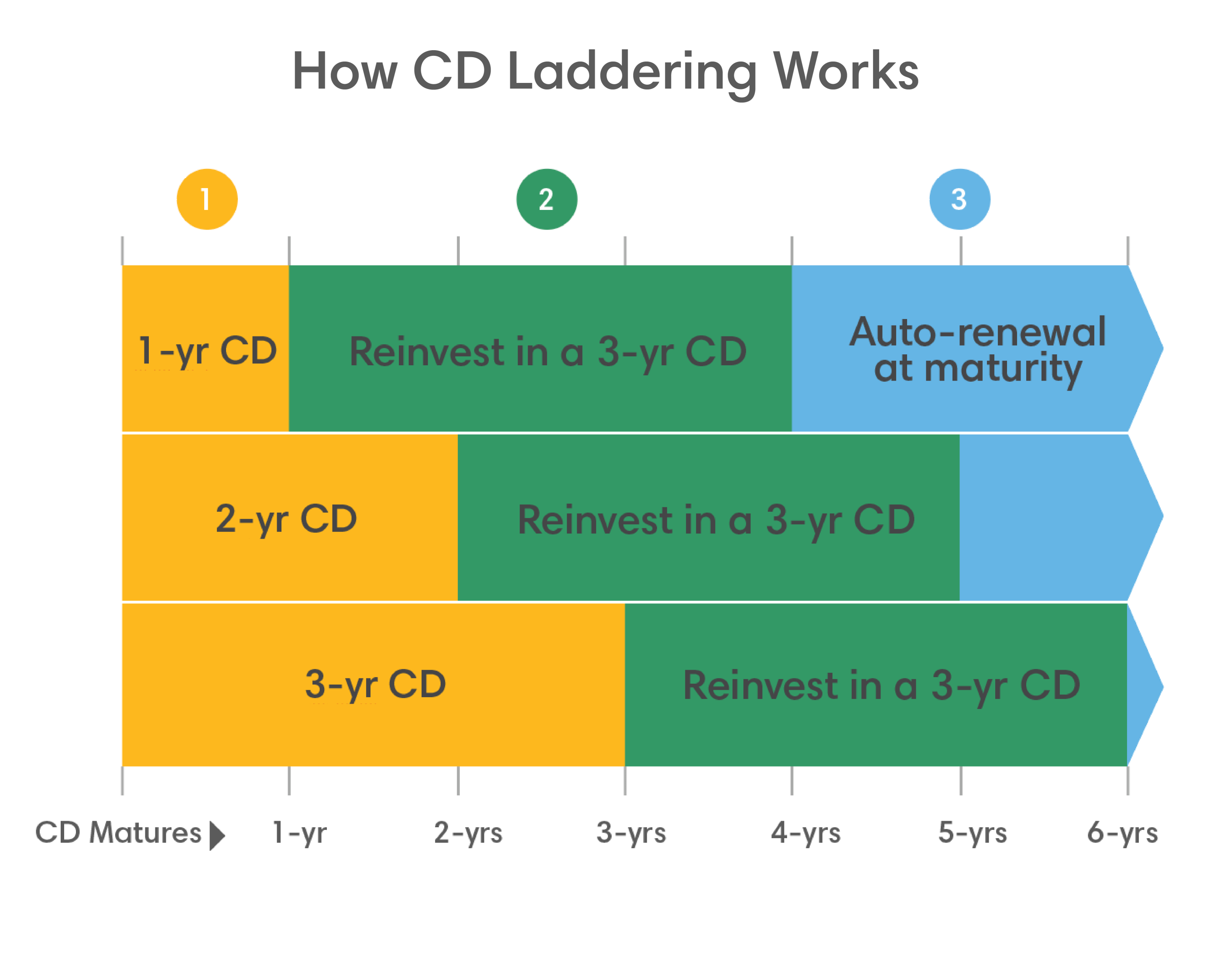

Reinvesting is a key part of maximizing returns with CD ladders. When a CD matures, you can reinvest the principal and interest into a new CD. This new CD should have the longest term in your ladder. For example:

- Year 1: 1-Year CD matures, reinvest in a 3-Year CD.

- Year 2: 2-Year CD matures, reinvest in a 3-Year CD.

- Year 3: 3-Year CD matures, reinvest in a new 3-Year CD.

By continuously reinvesting in longer-term CDs, you can maintain a steady stream of maturing CDs. This approach helps you stay flexible and take advantage of rising interest rates. If rates increase, your maturing CDs can be reinvested at the new higher rates, boosting your overall returns.

In summary, using a CD ladder strategy can help you maximize returns through better interest rates and smart reinvesting strategies. This method provides a balanced approach to managing your investments, keeping some funds accessible while earning higher returns on others.

Credit: www.firstcitizens.com

Managing Risks

Understanding how to manage risks is crucial when investing in CD ladders. This strategy can help you protect your investments from inflation, early withdrawal penalties, and other financial risks. Let’s explore these risks in detail.

Inflation Considerations

Inflation can erode the purchasing power of your savings. While CDs offer a fixed interest rate, this rate might not keep up with inflation. A CD ladder can help mitigate this risk by having multiple maturity dates. This allows you to reinvest your funds at potentially higher rates. Always keep an eye on inflation trends to make informed decisions.

Early Withdrawal Penalties

Withdrawing funds from a CD before its maturity date can incur penalties. These penalties can eat into your interest earnings and even your principal. By using a CD ladder, you can reduce the need for early withdrawals. You will have CDs maturing at regular intervals, providing liquidity when needed. It’s important to read the terms of each CD to understand the penalties involved.

Comparing Cd Ladders To Other Investments

Investing wisely is crucial for financial growth. One popular option is CD ladders. But how do they compare to other investments? Let’s explore this under two key headings: CDs vs. Savings Accounts and CDs vs. Bonds.

Cds Vs. Savings Accounts

Both CDs and savings accounts are safe places for your money. But there are some differences.

- Interest Rates: CDs usually offer higher interest rates than savings accounts. This means more earnings over time.

- Access to Funds: Savings accounts provide easy access to your money. CDs, on the other hand, lock your money for a set period.

- Minimum Balance: Savings accounts often have low or no minimum balance. CDs may require a higher initial deposit.

Choosing between CDs and savings accounts depends on your financial goals. If you need regular access to your money, a savings account is better. If you can lock your money away, CDs might be the better choice.

Cds Vs. Bonds

Bonds and CDs are both low-risk investments. But they serve different purposes.

| Feature | CDs | Bonds |

|---|---|---|

| Risk Level | Very low risk | Low to moderate risk |

| Interest Rates | Fixed interest rates | Variable interest rates |

| Duration | Short-term, 6 months to 5 years | Long-term, 10 to 30 years |

Bonds can offer higher returns but come with more risk. CDs are safer but with lower returns. Your choice will depend on your risk tolerance and investment horizon.

Credit: www.glcu.org

Tips For Success

Creating a Certificate of Deposit (CD) ladder can be a smart strategy to maximize your savings. But how do you ensure your ladder is successful? Below are some tips to make the most out of your CD ladder investment.

Regular Monitoring

It’s crucial to regularly monitor your CD ladder. By doing this, you can keep track of interest rates and maturity dates. Regular monitoring helps you stay informed about market conditions.

Use a spreadsheet or financial software to track your CDs. This can help you avoid missing important dates. It also helps in planning future investments.

Adjusting Your Ladder

Adjusting your ladder is key to optimizing returns. If interest rates rise, you might want to reinvest in higher-yield CDs. Conversely, if rates fall, locking in longer-term CDs can be beneficial.

Evaluate your financial goals periodically. Make adjustments to align your CD ladder with these goals. Flexibility ensures you make the most out of your investments.

Here’s a simple guide to help you adjust your CD ladder:

- Review your CD portfolio at least once a year.

- Compare interest rates from different banks.

- Reinvest matured CDs based on current rates.

- Consider your financial needs before making changes.

By following these tips, you can ensure your CD ladder works efficiently for you.

Frequently Asked Questions

What Is A Cd Ladder?

A CD ladder is an investment strategy using multiple certificates of deposit with different maturity dates.

How Do Cd Ladders Benefit Investors?

CD ladders offer liquidity and flexibility. They provide regular access to funds while earning interest.

How Do You Set Up A Cd Ladder?

Divide your investment into equal parts. Invest each part in CDs with staggered maturity dates.

What Are The Risks Of Cd Ladders?

The main risk is interest rate changes. If rates rise, older CDs might have lower returns.

Can Cd Ladders Help In Saving For Retirement?

Yes, CD ladders can provide a steady income stream, making them a good option for retirement savings.

Conclusion

CD ladders offer a secure way to grow your savings. They provide predictable returns and flexibility. By staggering maturity dates, you can access funds regularly. This approach balances liquidity and higher interest rates. It’s a practical strategy for conservative investors.

You can start with any amount, and it’s easy to set up. Remember to compare rates from different banks. Consider your financial goals and timeline. CD ladders can be a smart part of your savings plan. Explore this method to make your money work for you.

Safe and steady growth awaits.