CD laddering is a smart strategy for managing your investments. It helps maximize returns while reducing risks.

This method involves buying multiple certificates of deposit (CDs) with different maturity dates. People often wonder how to make the most of their savings without locking all their money away at once. CD laddering offers an excellent solution. By spreading your investments across different CDs, you can access funds at regular intervals.

This approach provides flexibility and better interest rates compared to a single, long-term CD. Whether you’re new to investing or looking for a safe way to grow your savings, understanding CD laddering can be beneficial. Keep reading to discover how this strategy works and how it can help you achieve your financial goals.

Credit: www.glcu.org

Introduction To Cd Laddering

Do you want to grow your savings with minimal risk? CD laddering is a great strategy. It involves spreading your investments over multiple Certificates of Deposit (CDs) with varying maturity dates. This method maximizes returns while providing regular access to your funds.

Concept And Benefits

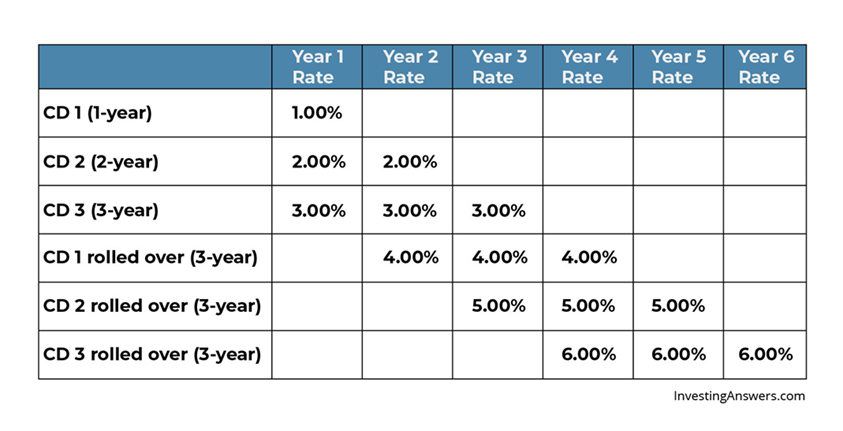

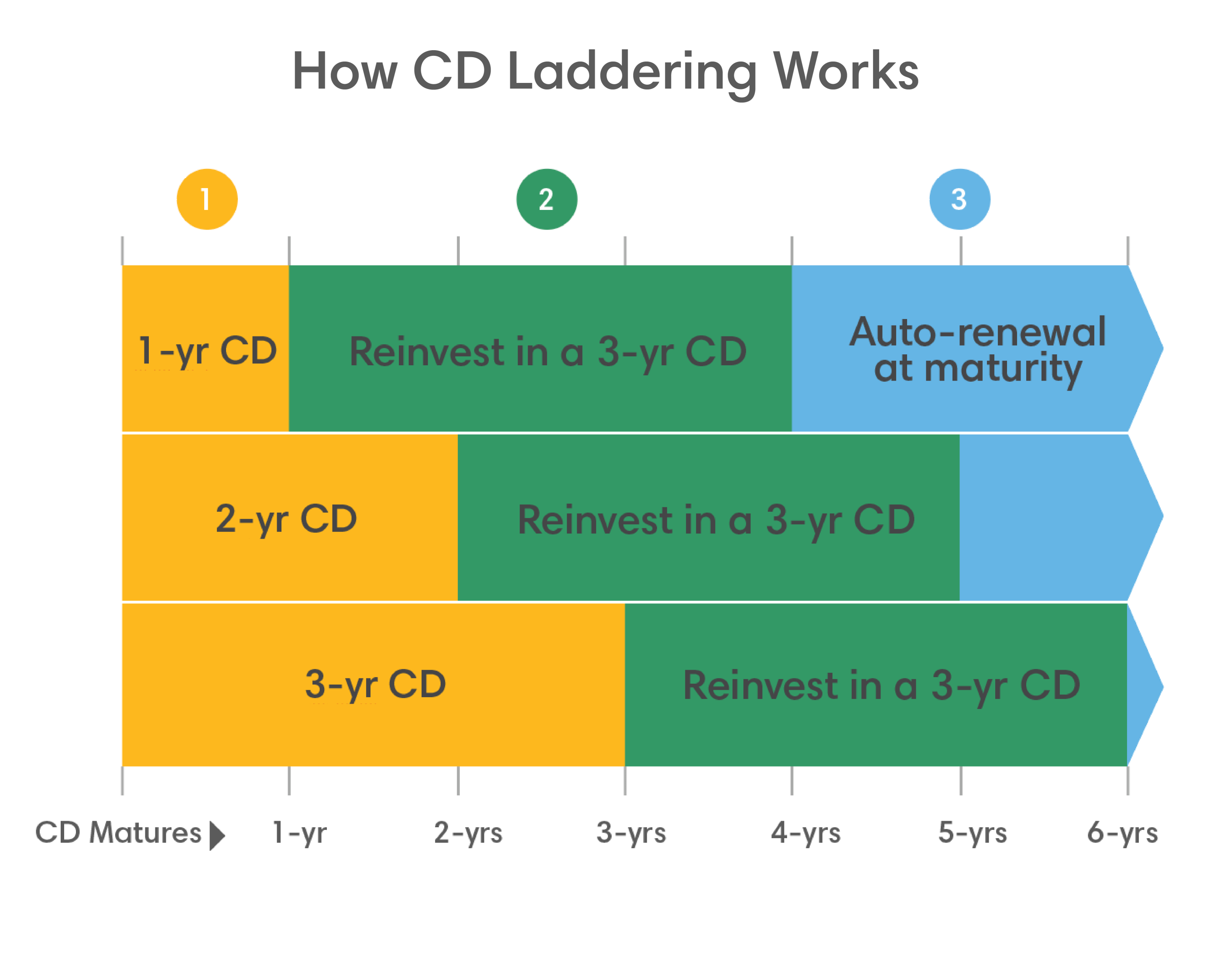

CD laddering means investing in multiple CDs with different terms. For example, you could invest in 1-year, 2-year, and 3-year CDs. As each CD matures, you reinvest it in a new longer-term CD. This way, you benefit from higher interest rates over time.

- Flexibility: Access funds regularly without breaking a CD.

- Higher Returns: Longer-term CDs usually offer better rates.

- Reduced Risk: Diversifying maturity dates reduces interest rate risk.

Why Choose Cd Laddering

CD laddering is an excellent choice for conservative investors. It offers a mix of safety, liquidity, and higher returns. Unlike a single long-term CD, it provides periodic access to your money. This reduces the risk of needing to break a CD early and facing penalties.

Consider this table to understand how a CD ladder might work:

| Investment Amount | Term | Interest Rate | Maturity Value |

|---|---|---|---|

| $1,000 | 1 Year | 1.5% | $1,015 |

| $1,000 | 2 Years | 2.0% | $1,040 |

| $1,000 | 3 Years | 2.5% | $1,075 |

By using CD laddering, you also benefit from the security of FDIC insurance. This protects your investment up to $250,000 per account holder, per institution. So, it’s a safe way to grow your savings.

Credit: agcu.org

Setting Up Your Cd Ladder

Setting up a CD ladder can be a smart way to manage your savings. It involves dividing your investment across multiple certificates of deposit (CDs) with different maturity dates. This strategy helps in gaining higher interest rates while maintaining some liquidity. Let’s break down the steps involved in setting up your CD ladder.

Choosing Initial Investment

Begin by determining the total amount you want to invest in CDs. Make sure to consider your financial goals and how much you can afford to set aside. Divide this total amount into equal parts. For example, if you have $10,000 to invest and plan to create a 5-step ladder, you would divide this amount into five parts of $2,000 each.

| Step | Amount |

|---|---|

| 1 | $2,000 |

| 2 | $2,000 |

| 3 | $2,000 |

| 4 | $2,000 |

| 5 | $2,000 |

Selecting Maturity Periods

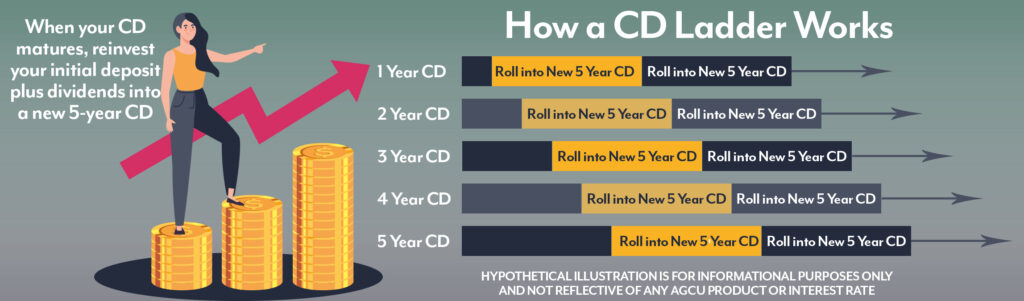

The next step is to select the maturity periods for each CD. A common approach is to spread the maturities over a range of time frames. For instance, you might choose 1-year, 2-year, 3-year, 4-year, and 5-year CDs. This way, one CD will mature each year, giving you access to your money periodically.

As each CD matures, you can reinvest the principal and interest into a new 5-year CD. This keeps your ladder going and potentially increases your overall returns. Here is an example of how this might look:

- Year 1: $2,000 in a 1-year CD

- Year 2: $2,000 in a 2-year CD

- Year 3: $2,000 in a 3-year CD

- Year 4: $2,000 in a 4-year CD

- Year 5: $2,000 in a 5-year CD

Once the first CD matures, reinvest that amount into a new 5-year CD. Repeat this process each year as CDs mature.

Managing Your Cd Ladder

Managing a CD ladder can help you get the most out of your investments. With a CD ladder, you spread your money across different certificates of deposit (CDs) that mature at different times. This strategy provides regular access to cash and better interest rates. But how do you manage this effectively? Let’s dive into some strategies.

Reinvestment Strategies

Reinvestment strategies are crucial for maintaining a successful CD ladder. When a CD matures, you have three main options:

- Reinvest in a new CD: Roll the matured funds into a new long-term CD. This keeps the ladder intact.

- Withdraw the funds: Take the money out if you need it for expenses or other investments.

- Adjust the ladder: Change the structure of the ladder to suit new financial goals.

Each option has its benefits. Reinvesting keeps your ladder growing. Withdrawing provides liquidity. Adjusting the ladder can help meet new financial goals.

Balancing Risk And Reward

Balancing risk and reward is key in managing a CD ladder. CDs are low-risk investments, but interest rates can vary.

To balance this, consider the following:

- Interest Rate Trends: Keep an eye on interest rate trends. Higher rates mean better returns.

- CD Terms: Mix short-term and long-term CDs. This ensures access to funds and better rates.

- Economic Conditions: Stay informed about the economy. It helps in making better investment choices.

Diversifying your CD terms helps manage risk. Combining different CDs can provide a steady return with less risk.

Managing your CD ladder requires attention and planning. By reinvesting wisely and balancing risk and reward, you can maximize your returns.

Maximizing Returns

CD laddering is a popular strategy to maximize returns on Certificates of Deposit (CDs). By spreading investments across multiple CDs with different maturity dates, you can enjoy steady interest income and better liquidity.

Interest Rate Considerations

Choosing the right interest rates is crucial. Higher rates lead to better returns. But short-term CDs usually offer lower rates than long-term ones. It’s wise to balance between the two.

- Short-term CDs: Typically offer lower interest rates.

- Long-term CDs: Generally provide higher interest rates.

Check current market rates before investing. Adjust your laddering strategy accordingly. This helps in seizing the best possible rates.

Optimal Ladder Structure

An optimal ladder structure involves dividing your total investment into equal parts. Each part is then invested in CDs with staggered maturity dates.

| Investment Amount | Maturity Period | Interest Rate |

|---|---|---|

| $2,000 | 1 year | 1.5% |

| $2,000 | 2 years | 1.7% |

| $2,000 | 3 years | 1.9% |

| $2,000 | 4 years | 2.1% |

| $2,000 | 5 years | 2.3% |

This structure ensures one CD matures each year. Reinvest the matured amount into a new 5-year CD. This keeps the ladder rolling and maximizes returns.

Comparing Cd Laddering With Other Investments

When considering how to invest your money, understanding the benefits and drawbacks of various options is crucial. One popular strategy is CD laddering. This approach involves investing in multiple certificates of deposit (CDs) with different maturity dates. Let’s compare CD laddering with other common investments.

Bonds Vs. Cd Laddering

Bonds and CDs are both low-risk investments. However, they have key differences. Bonds are debt securities issued by entities like governments or corporations. They pay interest over time and return the principal at maturity. CDs, on the other hand, are savings certificates from banks. They pay a fixed interest rate until the maturity date.

Comparing the two:

- Risk: Bonds can be riskier if the issuer defaults. CDs are insured by the FDIC, making them safer.

- Liquidity: Bonds can be sold before maturity, but at a potential loss. CDs usually incur a penalty for early withdrawal.

- Returns: Bonds generally offer higher returns than CDs. However, CD laddering can provide steady income with less risk.

Savings Accounts Vs. Cd Laddering

Savings accounts and CDs are both bank products. They help you save money and earn interest. But they have different features and benefits.

Here’s how they compare:

- Interest Rates: Savings accounts have variable interest rates. CDs offer higher, fixed rates.

- Access to Funds: Savings accounts allow easy access to your money. CDs lock your funds until maturity.

- Insurance: Both are FDIC insured, offering a similar level of safety.

While savings accounts offer flexibility, CD laddering can provide higher returns. This makes it a good option for long-term savings.

In summary, CD laddering offers a balanced approach. It combines safety, steady returns, and some flexibility. This makes it a valuable strategy in your investment portfolio.

Credit: www.firstcitizens.com

Tips For Successful Cd Laddering

CD laddering is a smart investment strategy. It offers a way to manage cash flow and earn interest. Here are some tips for successful CD laddering. Follow these to make the most of your investments.

avoiding Common Mistakes

Many investors make common mistakes with CD laddering. Avoid these pitfalls to ensure success:

- Not diversifying terms: Spread your CDs across different maturity dates.

- Ignoring penalties: Be aware of early withdrawal penalties.

- Neglecting to reinvest: Reinvest mature CDs to maintain the ladder.

- Overlooking rates: Shop around for the best interest rates.

staying Informed On Rates

Interest rates fluctuate. Stay informed to maximize your returns:

- Monitor the market: Keep an eye on interest rate trends.

- Compare rates: Use online tools to compare CD rates.

- Consult experts: Seek advice from financial advisors.

Remember, a well-planned CD ladder can provide steady income and growth. By avoiding common mistakes and staying informed on rates, you can make the most of your investment.

Frequently Asked Questions

What Is Cd Laddering?

CD laddering is an investment strategy. It involves buying multiple certificates of deposit (CDs) with different maturity dates.

Why Is Cd Laddering Beneficial?

It provides liquidity and flexibility. You have regular access to your money as CDs mature at different times.

How Do You Create A Cd Ladder?

Buy CDs with staggered maturity dates. For example, buy 1-year, 2-year, and 3-year CDs at the same time.

What Are The Risks Of Cd Laddering?

CD laddering carries low risk. The main risk is potential changes in interest rates affecting returns.

Can Cd Laddering Maximize Interest Earnings?

Yes, it can. By reinvesting maturing CDs, you can take advantage of potentially higher interest rates over time.

Conclusion

Cd laddering offers a smart way to manage your savings. It provides flexibility and maximizes interest earnings. By staggering maturity dates, you can access funds regularly. This strategy reduces risk and ensures steady returns. Start small, and adjust as you learn.

Cd laddering can suit various financial goals. Give it a try and watch your savings grow.