Laddering CDs is a smart savings strategy. It helps maximize returns and manage risk.

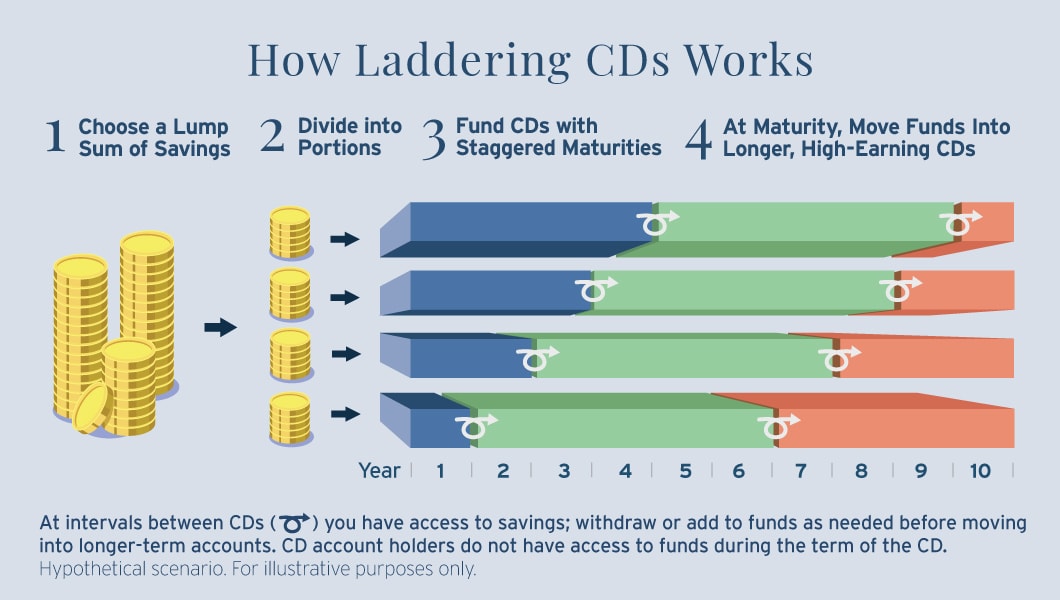

But how does it work? Laddering CDs, or certificates of deposit, involves splitting your investment into several CDs with different maturity dates. This approach allows you to benefit from potentially higher interest rates over time while still having access to some of your funds at regular intervals.

It’s a way to balance the need for liquidity with the goal of earning more interest on your savings. In this blog post, we will explain the concept of laddering CDs and how it can be a beneficial strategy for your financial planning. Whether you’re new to investing or looking for a safer option, understanding laddering CDs can help you make informed decisions about your money.

Introduction To Laddering Cds

Investing in Certificates of Deposit (CDs) is a popular strategy for those seeking a safe and steady return. Laddering CDs is a method used to optimize these investments, balancing flexibility with higher yields. This guide will explain the basics of laddering CDs and its benefits.

What Is A Cd Ladder?

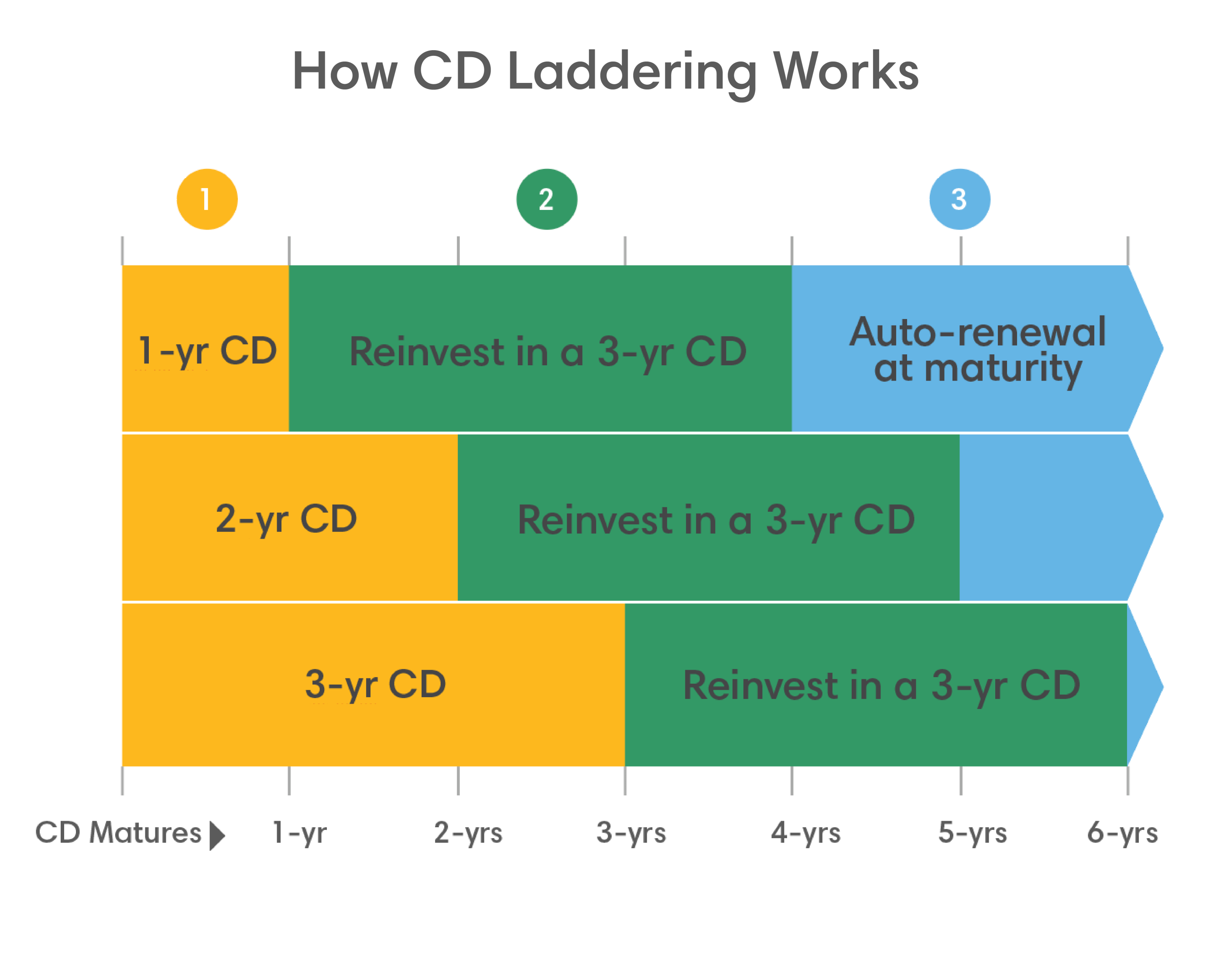

A CD ladder is a series of CDs that mature at regular intervals. Instead of putting all your money into one CD with a single maturity date, you spread it across multiple CDs with different terms.

For example, you might invest in five CDs with terms of 1, 2, 3, 4, and 5 years. As each CD matures, you reinvest the principal and interest in a new 5-year CD. This way, you have access to your funds at regular intervals while benefiting from higher interest rates on longer-term CDs.

Benefits Of Laddering Cds

Laddering CDs offers several advantages:

- Flexibility: Regular maturity dates provide access to cash when needed.

- Higher Yields: Longer-term CDs typically offer higher interest rates.

- Reduced Interest Rate Risk: Spreading investments across different terms minimizes the impact of fluctuating rates.

- Steady Income: Regularly maturing CDs provide a consistent stream of interest income.

Here’s a simple table illustrating a 5-year CD ladder:

| Year | CD Term | Action |

|---|---|---|

| 1 | 1 Year | Reinvest in a 5-Year CD |

| 2 | 2 Years | Reinvest in a 5-Year CD |

| 3 | 3 Years | Reinvest in a 5-Year CD |

| 4 | 4 Years | Reinvest in a 5-Year CD |

| 5 | 5 Years | Reinvest in a 5-Year CD |

In summary, laddering CDs is a smart strategy for managing investments. It combines flexibility, higher yields, and reduced risk. This method ensures you can maximize your returns while maintaining access to your funds.

Credit: www.lifeandmoney.citi.com

Steps To Build A Cd Ladder

Building a CD ladder is a smart investment strategy. It helps you manage your money while earning interest. Follow these simple steps to create your own CD ladder.

Choosing Your Initial Investment

First, decide how much money you want to invest. This amount will be divided among several CDs. It’s important to choose an amount that you are comfortable with. Remember, you won’t have access to this money until each CD matures.

Selecting Cd Terms

Next, choose the terms for your CDs. This means deciding how long each CD will last. Common terms are 1 year, 2 years, 3 years, 4 years, and 5 years. By spreading your investment across different terms, you can access a portion of your money each year.

| CD Term | Amount | Maturity Date |

|---|---|---|

| 1 Year | $1,000 | 1 Year from Now |

| 2 Years | $1,000 | 2 Years from Now |

| 3 Years | $1,000 | 3 Years from Now |

| 4 Years | $1,000 | 4 Years from Now |

| 5 Years | $1,000 | 5 Years from Now |

Using this table, you can see how your money will be invested. Each year, one CD will mature, giving you access to that money. You can then reinvest it into a new 5-year CD. This keeps the ladder going and helps you earn more interest over time.

Maximizing Returns With Laddering

Laddering Certificates of Deposit (CDs) is a smart way to manage your investments. This method helps you spread your money across multiple CDs with different maturity dates. By doing this, you can take advantage of changing interest rates and have regular access to your money.

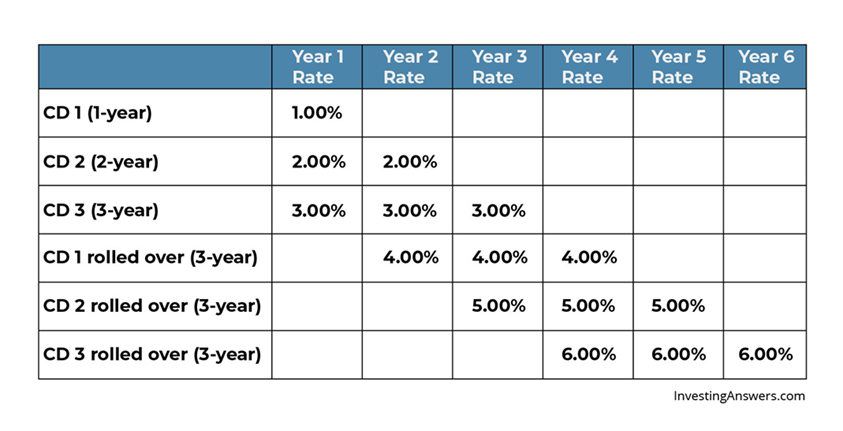

Reinvesting Matured Cds

When a CD matures, you have a few options. One option is to reinvest the money into a new CD. This keeps your money growing and earning interest. Reinvesting allows you to take advantage of the best interest rates available at that time.

Consider this example:

| CD Term | Interest Rate |

|---|---|

| 1 Year | 1.5% |

| 2 Years | 2.0% |

| 3 Years | 2.5% |

With laddering, you might have a CD maturing every year. When the 1-year CD matures, reinvest it into a new 3-year CD. This keeps the ladder going and maximizes your returns.

Adjusting For Interest Rate Changes

Interest rates can change over time. When rates go up, you want to capture those higher returns. Laddering CDs helps you do that. As each CD matures, you can reinvest at the current higher rates. This way, your overall return improves.

Conversely, if rates go down, only a part of your investment is affected. The rest remains locked in higher rates from before. This balance protects you from losing too much interest.

Here is a quick guide to adjust for rate changes:

- Monitor interest rate trends regularly.

- Check the rates of new CDs before reinvesting.

- Adjust your ladder as needed to optimize returns.

By using laddering, you make the most of your CDs. This strategy helps you manage your investments wisely and maximize returns.

Credit: www.glcu.org

Comparing Cd Laddering To Other Strategies

Understanding how CD laddering stacks up against other investment strategies is crucial. This section compares CD laddering with traditional savings accounts and stock investments. You’ll see the benefits and drawbacks of each.

Cd Laddering Vs. Traditional Savings

CD laddering offers better interest rates than traditional savings accounts. Banks usually offer higher rates for CDs compared to regular savings. This makes CD laddering a more profitable option for long-term savings.

Traditional savings accounts provide easy access to your money. You can withdraw funds anytime without penalties. CD laddering locks your money for a specific period. Early withdrawal may result in penalties.

| Feature | CD Laddering | Traditional Savings |

|---|---|---|

| Interest Rates | Higher | Lower |

| Access to Funds | Restricted | Flexible |

| Penalties | Possible for early withdrawal | None |

Cd Laddering Vs. Stock Investments

CD laddering is less risky compared to stock investments. Stocks are volatile and can lose value quickly. CDs offer a fixed return, making them a safer choice.

Stock investments can provide higher returns over time. This is especially true for well-performing stocks. CD laddering offers modest returns but with more security. Investors must decide their risk tolerance before choosing.

- Risk: Lower with CD laddering, higher with stocks.

- Returns: Higher potential with stocks, stable with CDs.

- Liquidity: Stocks are more liquid; CDs have fixed terms.

CD laddering provides a balanced approach to saving and investing. It ensures better rates than traditional savings and more security than stocks.

Risks And Considerations

While laddering CDs can be a smart investment strategy, it is important to understand the risks and considerations involved. This section will cover two key risks: market risks and the impact of inflation.

Market Risks

CDs are generally safe, but they are not completely free from market risks. Interest rates can fluctuate, affecting the value of your CDs. If interest rates rise, newer CDs will offer higher returns, making your older CDs less attractive. This can result in opportunity cost.

Also, early withdrawal penalties can reduce your earnings. If you need to access your money before the CD matures, you might lose a portion of the interest. Always check the terms and conditions before committing.

Inflation Impact

Inflation can erode the purchasing power of your returns. Even if you earn interest on your CDs, rising prices can diminish the value of those earnings. For example, if your CD yields 2% but inflation is 3%, you effectively lose 1% in purchasing power.

It is important to consider the real rate of return when investing in CDs. The real rate of return adjusts for inflation, giving you a clearer picture of your investment’s growth. Keep an eye on inflation trends to make informed decisions.

Tips For Successful Cd Laddering

Creating a CD ladder can be a smart investment strategy. It helps you maximize interest while maintaining liquidity. Here are some tips for successful CD laddering to ensure you get the most out of your investments.

Diversifying Investment Amounts

Diversify your investment amounts to spread risk and optimize returns. Instead of putting all your money into one CD, divide it into smaller amounts across multiple CDs with different maturities. This way, you can take advantage of varying interest rates and reduce the impact of rate fluctuations.

For example, if you have $10,000 to invest, consider allocating it as follows:

| Amount | Maturity |

|---|---|

| $2,000 | 1-year CD |

| $2,000 | 2-year CD |

| $2,000 | 3-year CD |

| $2,000 | 4-year CD |

| $2,000 | 5-year CD |

This approach ensures that some of your money is always available at different intervals. It also allows you to reinvest at potentially higher rates.

Staying Informed On Rates

Stay informed on interest rates to make the most of your CD ladder. Interest rates can change frequently, and staying updated helps you make timely decisions. Check financial news sources and bank websites regularly for the latest rate updates.

Consider setting up alerts or subscribing to newsletters from reputable financial institutions. This way, you won’t miss any important changes. Additionally, compare rates from different banks before reinvesting a matured CD. Some banks may offer better rates for the same term.

By keeping an eye on the rates, you can adjust your strategy accordingly. For example, if rates are expected to rise, you might choose shorter-term CDs to take advantage of higher rates later.

Following these tips can help you build a successful CD ladder, balancing risk and reward effectively.

Credit: www.firstcitizens.com

Frequently Asked Questions

What Is A Cd Ladder?

A CD ladder is a savings strategy. It involves opening multiple certificates of deposit (CDs) with different maturity dates.

Why Should I Use A Cd Ladder?

A CD ladder helps manage interest rates. It provides liquidity while earning better interest than a regular savings account.

How Do I Start A Cd Ladder?

To start a CD ladder, open several CDs with varying terms. Common terms are 1, 2, 3, 4, and 5 years.

What Are The Benefits Of Cd Laddering?

Benefits include higher interest rates and flexibility. You can access funds at regular intervals as each CD matures.

Is Cd Laddering Safe?

Yes, CD laddering is safe. CDs are typically insured by FDIC up to $250,000 per depositor, per insured bank.

Conclusion

Laddering CDs can be a smart strategy for savers. It spreads your investments across multiple maturity dates. This way, you benefit from higher interest rates. Also, you gain regular access to funds as CDs mature. This method reduces risk and maximizes returns.

With careful planning, laddering CDs helps achieve financial goals. Start small and watch your savings grow over time.