A CD ladder is a smart way to save money. It offers higher interest rates with less risk.

In today’s financial landscape, everyone seeks safe and profitable ways to grow their savings. A CD ladder is one such strategy that provides an excellent balance between risk and reward. By spreading your investments across multiple certificates of deposit (CDs) with different maturity dates, you can enjoy the benefits of both short-term and long-term interest rates.

This method not only maximizes your earnings but also ensures you have regular access to your funds. Whether you’re a seasoned investor or just starting, understanding CD ladders can help you make more informed decisions about your savings strategy. So, let’s dive in and explore what CD ladders are and how they can benefit you.

Introduction To Cd Ladders

CD ladders are a strategy to earn more from your savings. They offer a mix of liquidity and higher interest rates. This method involves investing in multiple CDs with different maturity dates.

What Is A Cd Ladder?

A CD ladder is a series of CDs with staggered maturity dates. You divide your investment into equal parts and invest in CDs that mature at different times. For instance, one part might mature in one year, another in two years, and so on. This way, you have regular access to your funds.

This structure allows you to take advantage of higher interest rates on longer-term CDs. At the same time, it provides liquidity at regular intervals. When a CD matures, you can reinvest in a new long-term CD or use the money as needed.

Benefits Of Cd Ladders

- Higher Interest Rates: Longer-term CDs typically offer better rates. A CD ladder helps you earn more over time.

- Regular Access to Funds: With staggered maturity dates, you can access your money periodically.

- Reduced Interest Rate Risk: By spreading your investments, you mitigate the impact of fluctuating rates.

- Diversification: CD ladders diversify your savings, reducing the risk of having all funds in one CD.

Here is an example of a 5-year CD ladder:

| Investment | Maturity Term | Interest Rate |

|---|---|---|

| $2,000 | 1 Year | 1.5% |

| $2,000 | 2 Years | 1.75% |

| $2,000 | 3 Years | 2.0% |

| $2,000 | 4 Years | 2.25% |

| $2,000 | 5 Years | 2.5% |

With a CD ladder, you balance liquidity and earnings. It’s a smart way to save with less risk and more reward.

Credit: www.sandyspringbank.com

How Cd Ladders Work

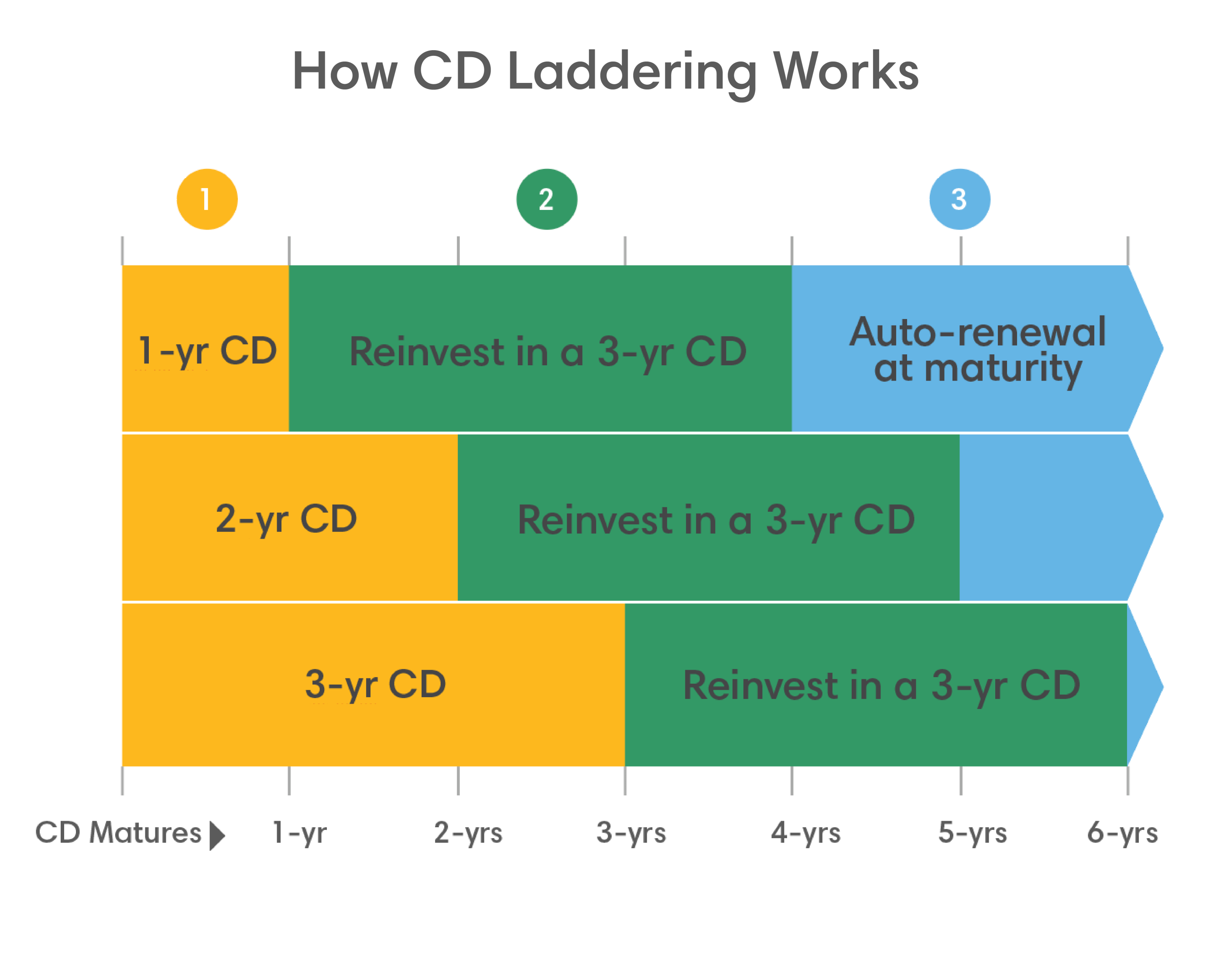

Understanding how CD ladders work can help you get more from your savings. A CD ladder is a savings strategy that involves multiple certificates of deposit (CDs) with different maturity dates. This approach provides a balance of liquidity and higher interest rates.

Step-by-step Process

Building a CD ladder is simple. Follow these steps to get started:

- Determine your investment amount: Decide how much money you want to invest in the CD ladder.

- Choose your CD terms: Select CDs with different maturity dates. For example, 1-year, 2-year, 3-year, 4-year, and 5-year terms.

- Divide your investment: Split your total investment amount equally among the selected CD terms.

- Open the CDs: Invest in the CDs according to your plan.

- Reinvest or withdraw: When a CD matures, you can reinvest it in a new CD or withdraw the funds.

Building A Cd Ladder

Let’s look at an example of building a CD ladder with $10,000:

| CD Term | Investment Amount | Interest Rate |

|---|---|---|

| 1-year CD | $2,000 | 2% |

| 2-year CD | $2,000 | 2.5% |

| 3-year CD | $2,000 | 3% |

| 4-year CD | $2,000 | 3.5% |

| 5-year CD | $2,000 | 4% |

Each year, one CD will mature, giving you access to part of your funds. You can then reinvest the matured amount into a new 5-year CD. This way, you always have one CD maturing every year.

Building a CD ladder helps you benefit from higher interest rates while maintaining some liquidity. It’s a strategy that balances risk and reward effectively.

Types Of Cd Ladders

Investors often use CD ladders to spread out their investments over time. This strategy helps manage interest rate risk and ensures liquidity. Let’s explore the different types of CD ladders.

Short-term Cd Ladders

Short-term CD ladders typically range from 3 months to 1 year. These ladders are ideal for those who seek quick access to their funds. They offer a mix of flexibility and stability.

- 3-Month CDs

- 6-Month CDs

- 9-Month CDs

- 12-Month CDs

With short-term CD ladders, you can reinvest your money every few months. This allows you to take advantage of rising interest rates.

Long-term Cd Ladders

Long-term CD ladders range from 2 years to 5 years or more. These ladders are suited for those who do not need immediate access to their funds. They typically offer higher interest rates.

- 2-Year CDs

- 3-Year CDs

- 4-Year CDs

- 5-Year CDs

Long-term CD ladders provide stability and higher returns. They are a good choice for long-term financial goals.

Long-term ladders also help in diversifying your investment portfolio.

Choosing The Right Cds

Choosing the right CDs for your laddering strategy can be overwhelming. It involves understanding the various factors that can impact your returns. Let’s dive into two important aspects: Interest Rates and Maturity Periods.

Interest Rates

Interest rates play a crucial role in your CD ladder’s success. They determine how much your investment will grow over time. Higher rates mean higher returns.

Interest rates can vary based on the term length and the financial institution offering the CD. Typically, longer-term CDs offer higher interest rates. Compare rates from different banks and credit unions. Look for competitive rates to maximize your earnings.

Maturity Periods

The maturity period of a CD is the length of time your money is locked in. CD ladders involve using CDs with different maturity periods. This strategy helps you access funds at regular intervals.

Here is an example of a CD ladder:

| Term Length | Interest Rate |

|---|---|

| 1 Year | 1.5% |

| 2 Years | 1.7% |

| 3 Years | 1.9% |

| 4 Years | 2.0% |

| 5 Years | 2.2% |

In this example, you invest in CDs with 1, 2, 3, 4, and 5-year terms. Each year, a CD matures, providing liquidity. You can then reinvest in a new 5-year CD, potentially at a higher rate.

Using CDs with different maturity periods can balance your need for access to funds and higher returns. Plan your ladder based on your financial goals and liquidity needs.

Maximizing Returns

Maximizing returns with CD ladders can offer a balanced approach to investing. This strategy helps to spread risk while improving overall returns. Let’s explore two key aspects: reinvesting strategy and diversification.

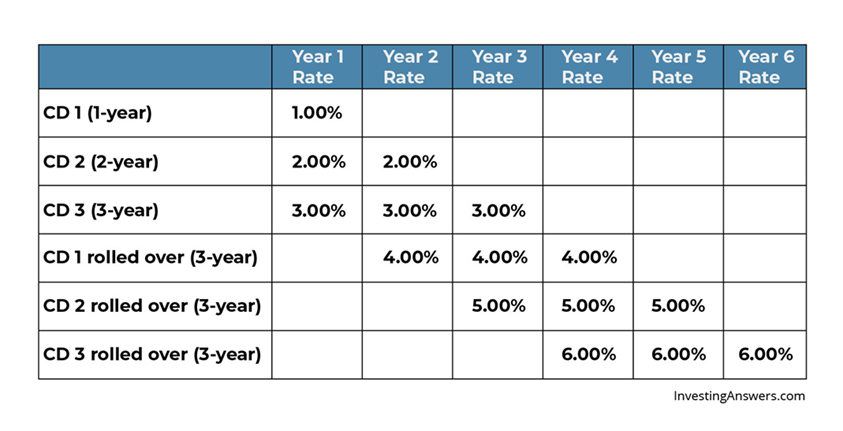

Reinvesting Strategy

A smart reinvesting strategy is crucial in maximizing returns. When a CD matures, you reinvest the principal into a new CD with a longer term. This allows you to take advantage of higher interest rates over time.

For example:

| Term | Interest Rate | Reinvestment Period |

|---|---|---|

| 1 Year | 1.5% | Reinvest into 3-Year CD |

| 2 Year | 2.0% | Reinvest into 4-Year CD |

| 3 Year | 2.5% | Reinvest into 5-Year CD |

This method ensures a steady flow of income while gradually moving into higher-yield CDs.

Diversification

Diversification helps reduce risk by spreading investments across different CDs. By investing in CDs with varying terms and rates, you mitigate the impact of interest rate fluctuations.

Consider these key points for effective diversification:

- Different Maturity Dates: Invest in CDs that mature at different times. This provides liquidity at regular intervals.

- Varying Interest Rates: Choose CDs with different interest rates. This ensures you benefit from higher rates when available.

- Multiple Banks: Spread your investments across different banks. This reduces the risk associated with any single institution.

By diversifying your CD ladder, you create a more resilient and profitable investment strategy.

Credit: www.glcu.org

Risks And Considerations

CD Ladders can be a safe investment. But they are not without risks. Understanding these risks is crucial. This helps you make informed decisions. Let’s explore some potential risks and considerations.

Market Risks

The primary risk with CD Ladders is market risk. Interest rates can change. When rates rise, new CDs offer higher returns. This can make your older CDs less valuable. You might miss out on better rates. Also, inflation can erode your earnings. If the inflation rate is high, your returns might not keep up. This reduces the real value of your investment.

Early Withdrawal Penalties

CDs are designed to be held until maturity. If you need to withdraw early, you will face penalties. These penalties can be significant. They often include losing several months of interest. This can eat into your principal. Here is a quick look at potential penalties:

| Term Length | Penalty |

|---|---|

| 6 months or less | 1-3 months of interest |

| 6-12 months | 3-6 months of interest |

| More than 12 months | 6-12 months of interest |

Consider these penalties before committing to a CD Ladder. Make sure you won’t need access to your money early. This helps avoid costly penalties.

Credit: www.firstcitizens.com

Frequently Asked Questions

What Is A Cd Ladder?

A CD ladder is a savings strategy. It involves multiple certificates of deposit (CDs) with different maturity dates.

How Does A Cd Ladder Work?

A CD ladder works by splitting your investment into several CDs. Each CD has a different term length.

Why Should I Use A Cd Ladder?

A CD ladder offers better interest rates. It also provides regular access to some of your money.

What Are The Benefits Of Cd Ladders?

Benefits include higher returns than savings accounts. They also reduce interest rate risk and increase liquidity.

Can I Build A Cd Ladder With Any Amount Of Money?

Yes, you can start a CD ladder with any amount. Just split your funds across multiple CDs.

Conclusion

A CD ladder is a smart investment strategy. It balances risk and reward. Using CD ladders, you spread your money across multiple CDs. This approach provides steady returns and liquidity. Many investors find CD ladders helpful for managing savings. They offer a predictable income stream.

They also protect against interest rate fluctuations. Consider CD ladders for a safer, more structured investment plan. They can help you meet your financial goals.