A CD laddering strategy involves spreading investments across multiple Certificates of Deposit with different maturity dates. This helps manage risk and access funds at regular intervals.

A CD laddering strategy is a smart way to invest in Certificates of Deposit (CDs). It involves buying CDs that mature at different times. For example, you might buy a 1-year, 2-year, 3-year, 4-year, and 5-year CD. This way, you have a CD maturing every year.

This strategy helps you get better interest rates while still having access to your money periodically. If rates go up, you can reinvest in higher-yield CDs. This approach balances security and liquidity, making it ideal for cautious investors. It’s simple to set up and can be a good fit for those who want steady returns with low risk.

Introduction To Cd Laddering

CD Laddering is a smart investment strategy. It helps maximize your returns while keeping your money safe. This strategy involves spreading your investments across multiple Certificates of Deposit (CDs) with different maturity dates. By doing this, you can benefit from higher interest rates without locking all your money for long periods.

Concept Of Cd Laddering

The concept of CD Laddering is simple yet effective. You divide your investment into equal parts. Each part is then placed into a CD with different maturity dates. For example, if you have $10,000, you could invest in five CDs of $2,000 each with maturities of 1, 2, 3, 4, and 5 years.

| Investment Amount | Maturity Date | Interest Rate |

|---|---|---|

| $2,000 | 1 Year | 1.5% |

| $2,000 | 2 Years | 2.0% |

| $2,000 | 3 Years | 2.5% |

| $2,000 | 4 Years | 3.0% |

| $2,000 | 5 Years | 3.5% |

As each CD matures, you reinvest the principal and interest into a new CD. This continues the laddering process. The goal is to maintain liquidity and earn higher interest rates over time.

Benefits Of Cd Laddering

CD Laddering offers several key benefits:

- Higher Returns: You can access higher interest rates with longer-term CDs.

- Liquidity: Not all your money is locked up. You have regular access to funds as CDs mature.

- Reduced Risk: Your investment is spread across different maturity dates. This reduces interest rate risk.

- Flexibility: You can adjust your strategy based on changing interest rates and financial needs.

This strategy is ideal for conservative investors. It provides a balance between risk and reward. It ensures that your money grows steadily and safely.

Credit: www.usaa.com

How Cd Laddering Works

The CD Laddering Strategy is a smart way to manage your savings. It helps you earn interest while keeping some flexibility. Let’s dive into how CD laddering works.

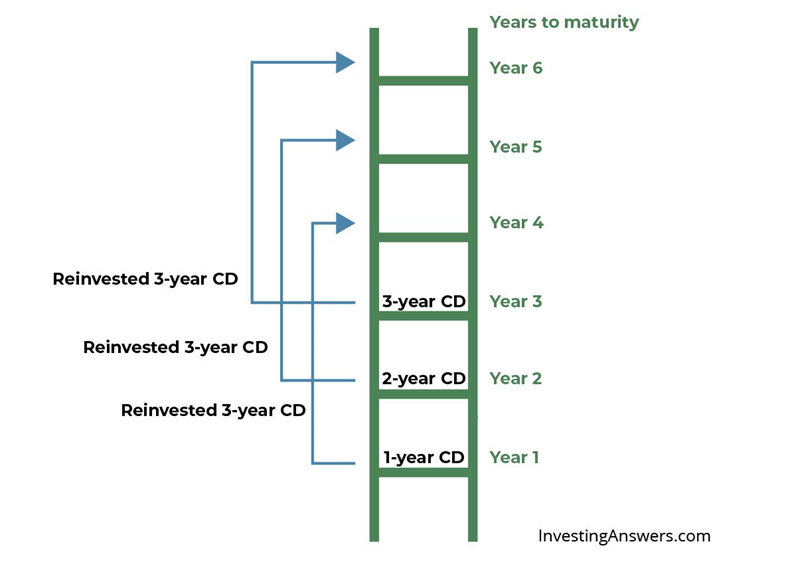

Step-by-step Process

Follow these simple steps to set up a CD ladder:

- Divide your investment: Split your total amount into equal parts.

- Choose different terms: Invest each part in CDs with varying terms.

- Stagger the maturity dates: Ensure each CD matures at different times.

- Reinvest upon maturity: When a CD matures, reinvest in a new long-term CD.

Example Of A Cd Ladder

Here is an example to make it clearer:

| Amount | Term | Maturity Date |

|---|---|---|

| $1,000 | 1 year | 2024 |

| $1,000 | 2 years | 2025 |

| $1,000 | 3 years | 2026 |

| $1,000 | 4 years | 2027 |

| $1,000 | 5 years | 2028 |

In this example, you have five CDs. Each has a different maturity date. Each year, one CD matures. You can reinvest it in a new 5-year CD. This way, you always have one CD maturing every year. This provides both liquidity and higher interest rates.

Advantages Of Cd Laddering

The CD laddering strategy offers several benefits for investors. This approach involves spreading out investments across multiple Certificates of Deposit (CDs) with varying maturity dates. By doing so, investors can optimize their returns while maintaining a degree of liquidity. Below, we explore the key advantages of CD laddering.

Increased Liquidity

One of the main benefits of a CD laddering strategy is increased liquidity. Investors can access their money at regular intervals. For instance, if you create a ladder with 1-year, 2-year, and 3-year CDs, one CD will mature every year. This allows investors to reinvest or use the funds as needed without penalties.

Here is an example:

| CD Term | Maturity Date |

|---|---|

| 1-Year CD | 2024 |

| 2-Year CD | 2025 |

| 3-Year CD | 2026 |

By following this strategy, investors do not tie up all their money for a long period.

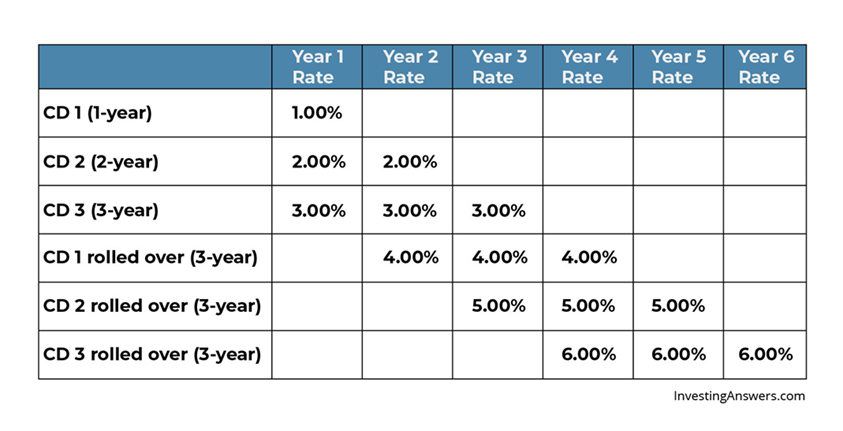

Higher Interest Rates

Another advantage of CD laddering is the potential for higher interest rates. Longer-term CDs typically offer higher rates compared to short-term ones. By investing in CDs with varying terms, investors can benefit from the higher rates of long-term CDs while still having access to funds through maturing short-term CDs.

Here’s a comparison:

- 1-Year CD: 1.5%

- 2-Year CD: 2.0%

- 3-Year CD: 2.5%

This mix allows for a balanced approach to earning higher returns while maintaining liquidity.

Credit: www.glcu.org

Setting Up A Cd Ladder

A CD laddering strategy is a smart way to maximize your savings. It involves investing in multiple Certificates of Deposit (CDs) with different maturity dates. This approach provides a steady stream of interest income while maintaining liquidity.

Choosing The Right Cds

Choosing the right CDs is crucial for a successful CD ladder. Look for CDs with competitive interest rates. Compare different banks and credit unions. Make sure the CDs are insured by the FDIC. This ensures your money is safe.

Consider the minimum deposit requirements. Some CDs need a higher initial deposit. Check the penalties for early withdrawal. These can reduce your earnings if you need access to your funds sooner.

Determining Ladder Intervals

Determining ladder intervals is the next step. Decide how often you want a CD to mature. Common intervals are every 3 months, 6 months, or 1 year.

Here’s a table to help you understand better:

| Interval | Number of CDs | Example |

|---|---|---|

| 3 months | 4 CDs | 3 months, 6 months, 9 months, 1 year |

| 6 months | 2 CDs | 6 months, 1 year |

| 1 year | 1 CD | 1 year |

Start with a shorter interval for more frequent access to funds. Longer intervals might offer higher interest rates.

Managing Your Cd Ladder

Managing a CD ladder involves reinvesting and tracking interest rates. This strategy helps maximize returns and maintain liquidity. Below, explore ways to manage your CD ladder effectively.

Reinvesting Strategies

Reinvesting is essential for a successful CD ladder. Once a CD matures, reinvest in a new CD.

- Short-Term CDs: Reinvest in short-term CDs for quick access to funds.

- Long-Term CDs: Choose long-term CDs for higher interest rates.

- Balanced Approach: Combine both short-term and long-term CDs.

A balanced approach ensures flexibility and maximizes returns.

| Term | Interest Rate | Reinvestment Option |

|---|---|---|

| 6 Months | 1.5% | Short-Term CD |

| 1 Year | 2.0% | Short-Term CD |

| 3 Years | 2.5% | Long-Term CD |

| 5 Years | 3.0% | Long-Term CD |

Monitoring Interest Rates

Interest rates fluctuate over time. Keeping an eye on rates helps optimize your CD ladder.

- Interest Rate Alerts: Sign up for alerts to stay updated.

- Market Analysis: Regularly check market trends and forecasts.

Monitoring rates ensures your investments yield the best returns.

Use these strategies to manage your CD ladder effectively. Stay informed and reinvest wisely.

Common Mistakes To Avoid

Using a CD laddering strategy can be a great way to invest. But there are common mistakes that many people make. Avoiding these mistakes will help you maximize your returns.

Ignoring Interest Rate Trends

One common mistake is ignoring interest rate trends. Interest rates can change over time. If you ignore these trends, you may miss better rates. Always keep an eye on the market. Compare the rates of different CDs before buying.

Here is a simple table to help you compare interest rates:

| Bank | 1-Year CD Rate | 2-Year CD Rate | 5-Year CD Rate |

|---|---|---|---|

| Bank A | 1.5% | 2.0% | 2.5% |

| Bank B | 1.7% | 2.2% | 2.6% |

| Bank C | 1.6% | 2.1% | 2.7% |

As you can see, the rates vary. Choosing the best rate will maximize your earnings.

Overlooking Fees

Another mistake is overlooking fees. Some banks charge fees for early withdrawals. These fees can eat into your returns. Make sure you understand all the fees before committing to a CD.

Here is a list of common fees you might encounter:

- Early withdrawal fees

- Account maintenance fees

- Minimum balance fees

Read the fine print. Know all the terms and conditions. This will help you avoid unexpected costs.

By avoiding these common mistakes, you can make the most out of your CD laddering strategy.

Credit: www.glcu.org

Frequently Asked Questions

What Is Cd Laddering Strategy?

CD laddering is an investment strategy. It involves buying multiple CDs with different maturity dates.

How Does Cd Laddering Work?

You purchase CDs with staggered maturity dates. This provides regular access to funds and better interest rates.

Benefits Of Cd Laddering?

It offers liquidity, reduced interest rate risk, and potentially higher returns compared to single CD investments.

Is Cd Laddering Safe?

Yes, it’s a low-risk strategy. CDs are typically insured by the FDIC, making them a secure investment.

Who Should Consider Cd Laddering?

Investors seeking stable returns and low risk. It’s ideal for those who want regular access to their money.

Conclusion

A CD laddering strategy offers a smart way to grow savings. It reduces risk and maximizes interest earnings over time. This method is easy to manage and flexible. By spreading investments, you ensure steady returns. Consider CD laddering to improve your financial planning and security.