A laddered continuing resolution is a budget strategy used by governments. It helps manage funds when the budget isn’t finalized.

In simple terms, a laddered continuing resolution allows temporary funding in stages. This approach ensures that government operations continue smoothly without disruption. Think of it as a financial bridge, preventing a shutdown while providing more time to finalize the budget.

This method offers stability and flexibility, giving lawmakers a buffer period. Understanding this concept can help you see how governments handle financial uncertainty. In the following sections, we will delve deeper into how a laddered continuing resolution works, its benefits, and its impact on government operations.

Credit: www.gao.gov

Introduction To Laddered Continuing Resolutions

Understanding the concept of Laddered Continuing Resolutions is vital for financial planning. This strategy helps manage government funding efficiently. It ensures continuity and stability in financial operations.

Concept Overview

A Laddered Continuing Resolution involves layering multiple resolutions with different end dates. This approach spreads financial risk over time. It avoids a single point of failure. The strategy is similar to laddering bonds. Each resolution covers a specific time frame. When one ends, another begins. This cycle keeps funds available continuously.

- Prevents sudden funding gaps

- Maintains operational stability

- Reduces financial risk

Here’s a simple table to illustrate the concept:

| Resolution | Start Date | End Date |

|---|---|---|

| Resolution 1 | January 1 | March 31 |

| Resolution 2 | April 1 | June 30 |

| Resolution 3 | July 1 | September 30 |

Each resolution starts as the previous one ends. This ensures no disruption in funding.

Historical Context

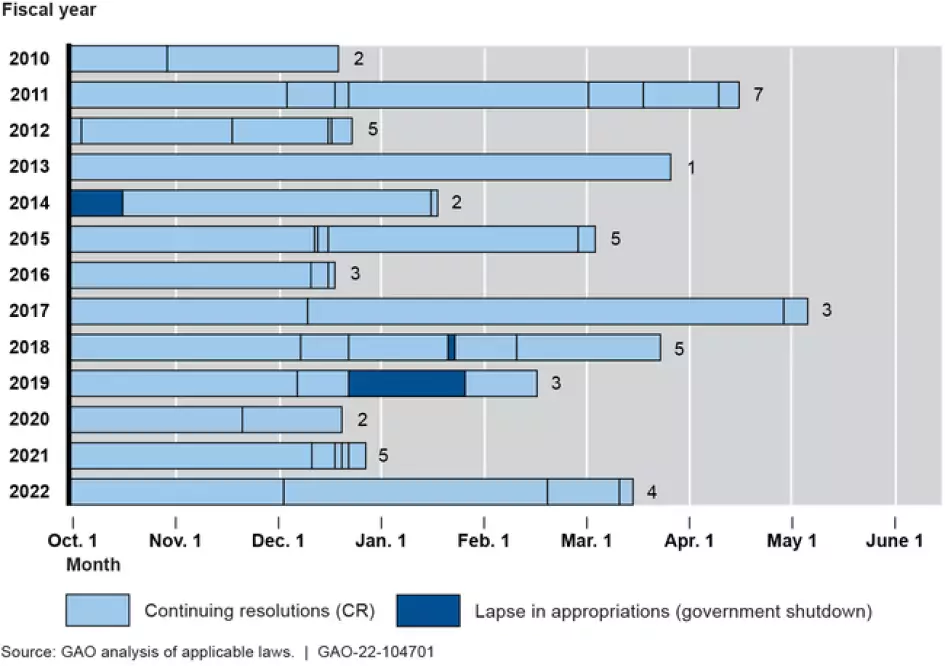

The practice of Continuing Resolutions began in the early 20th century. It arose from the need to prevent government shutdowns. Lawmakers realized single resolutions were not enough. They needed a more reliable system.

- 1920s: First use of continuing resolutions

- 1970s: Increased use due to budget delays

- 1990s: Introduction of laddered approach

The laddered approach became popular in the 1990s. It provided a more stable financial environment. This method has been refined over time. It is now a key tool in government financial management.

Credit: www.youtube.com

Benefits Of Laddered Continuing Resolutions

A Laddered Continuing Resolution is a financial strategy used to maintain funding for projects or operations without interruption. This method offers several benefits that make it an attractive choice for organizations. Here, we explore the primary advantages of using Laddered Continuing Resolutions.

Financial Flexibility

One of the most significant benefits of a Laddered Continuing Resolution is the increased financial flexibility it provides. This approach allows funds to be allocated in stages, rather than all at once. Organizations can manage their budgets more effectively.

- Adjust funding based on project needs.

- Allocate resources dynamically.

- Adapt to changing financial situations.

This flexibility ensures that the organization can respond to unforeseen expenses or changes in project scope. Furthermore, it helps in maintaining a balanced budget throughout the year.

Risk Mitigation

Another key benefit of Laddered Continuing Resolutions is risk mitigation. By spreading out funding over time, the organization can reduce the impact of financial uncertainties. This approach minimizes the risk of budget shortfalls.

- Less reliance on single, large funding approvals.

- Reduced impact of financial downturns.

- Improved project continuity.

In essence, this method helps to safeguard ongoing projects from sudden financial disruptions. It provides a buffer against unexpected economic changes, ensuring that essential operations continue smoothly.

Moreover, by using a Laddered Continuing Resolution, organizations can better anticipate and plan for potential financial risks. This proactive approach is crucial for maintaining stability and achieving long-term goals.

Implementing Laddered Continuing Resolutions

Understanding how to implement laddered continuing resolutions can be crucial for effective financial management. This strategy helps in maintaining liquidity and minimizing risks. Let’s explore the process step by step.

Step-by-step Guide

- Assess Current Financial Needs: Determine your short-term and long-term financial requirements.

- Identify Investment Options: Look for various fixed-income instruments like bonds and certificates of deposit (CDs).

- Divide Investments: Split your total investment into equal parts. Each part will be invested in different maturities.

- Invest in Staggered Maturities: Allocate each part to different timeframes, such as 1-year, 2-year, 3-year, etc.

- Reinvest Upon Maturity: As each investment matures, reinvest in the longest maturity available. This ensures a continuous ladder.

Key Considerations

- Liquidity Needs: Ensure that the investment schedule aligns with your cash flow requirements.

- Interest Rate Trends: Keep an eye on interest rate trends. They affect the yields of new investments.

- Risk Tolerance: Choose investments that match your risk tolerance. Higher yields often come with higher risks.

- Tax Implications: Understand the tax impact of your investments. Some may offer tax advantages.

| Investment Term | Interest Rate | Reinvestment Strategy |

|---|---|---|

| 1 Year | 2% | Reinvest in 5-Year Term |

| 2 Years | 2.5% | Reinvest in 5-Year Term |

| 3 Years | 3% | Reinvest in 5-Year Term |

Implementing a laddered continuing resolution strategy can help in managing finances effectively. By diversifying maturities, you can minimize risks and ensure liquidity. Remember to consider your specific financial needs and market conditions.

Challenges And Drawbacks

A laddered continuing resolution can provide flexibility in budgeting. But it also comes with certain challenges and drawbacks. Understanding these issues can help in better decision-making. Let’s explore the potential risks and common pitfalls associated with this approach.

Potential Risks

Laddered continuing resolutions can lead to uncertainty in funding. Agencies may not know their exact budget. This can cause delays in projects. It can also impact long-term planning.

Another risk is the administrative burden. Managing multiple resolutions can be complex. It requires more time and effort from staff. This can divert resources from other important tasks.

Interest rates may fluctuate over time. This can affect the cost of borrowing. Agencies might end up paying more in the long run.

Common Pitfalls

Miscommunication is a common issue. Different departments may not be on the same page. This can lead to misunderstandings and errors.

There is also the risk of overlapping schedules. Multiple resolutions may have different timelines. This can create confusion and inefficiency.

Lack of flexibility in spending can be a problem. Agencies may have to stick to the allocated budget. This can limit their ability to respond to unforeseen needs.

Political instability can impact funding. Changes in government policies can affect the availability of funds. This can cause disruptions in ongoing projects.

Increased administrative costs can be a concern. Managing multiple resolutions requires additional resources. This can strain the agency’s budget.

| Potential Risks | Common Pitfalls |

|---|---|

| Uncertainty in funding | Miscommunication |

| Administrative burden | Overlapping schedules |

| Interest rate fluctuations | Lack of flexibility |

| Political instability | Increased administrative costs |

Case Studies

Case studies provide real-world insights into the effectiveness of a Laddered Continuing Resolution (LCR). These examples help understand how different organizations have implemented LCR and the outcomes they achieved. Let’s explore some noteworthy cases that highlight the success and lessons learned from using LCR.

Successful Examples

Several organizations have successfully used LCR strategies to manage their budgets efficiently. Here are a few examples:

| Organization | Industry | Outcome |

|---|---|---|

| ABC Corp | Technology | Reduced budget shortfalls by 20% |

| XYZ Non-Profit | Healthcare | Maintained consistent funding for programs |

| LMN University | Education | Improved project completion rates by 15% |

Lessons Learned

Implementing a Laddered Continuing Resolution can be challenging. Here are some key lessons learned from the case studies:

- Strategic Planning: Effective LCR implementation requires thorough planning and foresight.

- Stakeholder Engagement: Involving all stakeholders ensures smoother transitions and better adoption.

- Monitoring and Evaluation: Regularly review and adjust strategies to meet evolving needs.

- Flexibility: Be prepared to adapt the LCR approach as circumstances change.

Credit: www.naco.org

Future Of Laddered Continuing Resolutions

The future of laddered continuing resolutions (CRs) looks promising. As governments seek stable financial planning, laddered CRs provide a structured approach. This method ensures continuous funding without disruptions. Let’s explore the emerging trends and long-term implications of laddered continuing resolutions.

Emerging Trends

Several trends are shaping the future of laddered continuing resolutions:

- Increased Adoption: More governments are adopting laddered CRs for budget stability.

- Technology Integration: Digital tools help in managing and forecasting budget needs.

- Collaboration: Enhanced cooperation between agencies ensures smooth implementation.

These trends highlight the growing importance of laddered CRs. They ensure that funding remains uninterrupted. This approach also reduces the risk of government shutdowns.

Long-term Implications

Laddered continuing resolutions have significant long-term implications:

| Implication | Description |

|---|---|

| Budget Stability | Ensures consistent funding and reduces financial uncertainty. |

| Improved Planning | Allows for better long-term financial planning and forecasting. |

| Reduced Disruptions | Minimizes the risk of government shutdowns and service interruptions. |

In the long run, laddered CRs promote stability. They help in better resource allocation and planning. This approach benefits both the government and the public.

Frequently Asked Questions

What Is A Laddered Continuing Resolution?

A Laddered Continuing Resolution is a budgeting method. It spreads funding over multiple periods.

How Does A Laddered Continuing Resolution Work?

It divides the budget into smaller parts. Each part is funded at different times.

What Are The Benefits Of Laddered Continuing Resolutions?

It provides more flexibility. It helps manage funding more effectively.

Who Uses Laddered Continuing Resolutions?

Governments and large organizations use them. They are useful for managing long-term projects.

How Does It Differ From A Regular Continuing Resolution?

A regular continuing resolution funds everything at once. A laddered one spreads out the funding.

Conclusion

A laddered continuing resolution offers a unique approach to budget management. It helps avoid government shutdowns by spreading out funding decisions. This method ensures smoother operations and reduces fiscal uncertainty. Lawmakers and agencies can plan better. It also promotes more thoughtful spending.

Understanding this strategy is crucial for informed discussions about government budgets. Stay updated on budget policies to grasp their full impact.