Bond laddering is an investment strategy. It involves buying bonds with different maturity dates.

Bond laddering helps manage interest rate risk. Investors buy bonds that mature at different times. This creates a steady income stream and reduces risk. By spreading out maturity dates, you can reinvest at varied rates. This strategy also provides liquidity.

Investors can access their funds as bonds mature. Bond laddering is simple and effective for many. It suits both new and experienced investors. It can be used with various bond types. This strategy offers a balanced approach to investing. It ensures steady returns and reduces market risk. Many find bond laddering a valuable part of their portfolio.

Credit: mp.morningstar.com

Introduction To Bond Laddering

Bond laddering is a popular strategy among investors. It involves purchasing bonds with different maturity dates. This method helps to manage interest rate risk and provides a steady income.

Concept Of Bond Laddering

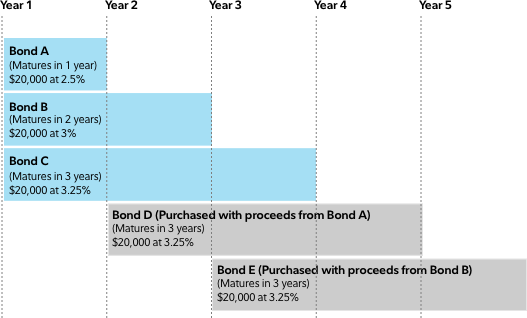

Bond laddering means buying multiple bonds that mature at different times. For example, an investor might buy bonds maturing in 1, 3, 5, 7, and 10 years. As each bond matures, the investor reinvests the principal into a new bond. This creates a continuous cycle of maturing bonds.

This strategy helps to spread the investment risk over time. Investors do not need to worry about all bonds maturing at once. It also ensures that part of the investment is always accessible.

Benefits Of Bond Laddering

Bond laddering offers several advantages:

- Steady Income: Regular income from maturing bonds.

- Reduced Risk: Spreads out interest rate risk.

- Flexibility: Reinvest maturing bonds as needed.

- Liquidity: Access to part of the investment regularly.

Bond laddering helps to manage the investment efficiently. It balances between risk and return. Investors can adjust the ladder based on their goals and market conditions.

Credit: www.schwab.com

How Bond Laddering Works

Bond laddering is a strategy to manage investments and reduce risk. It involves buying multiple bonds with different maturity dates. This helps investors receive regular income and protect against interest rate changes.

Mechanics Of Bond Laddering

Understanding the mechanics of bond laddering is essential. Here are the key steps:

- Purchase bonds with different maturity dates.

- Spread out the investment over several years.

- When a bond matures, reinvest the principal in a new bond.

This strategy ensures a steady cash flow and minimizes risk. Investors can take advantage of changing interest rates.

Building A Bond Ladder

Building a bond ladder involves several steps. Follow this guide:

- Decide the total amount to invest.

- Select bonds with varying maturities, such as 1, 3, 5, 7, and 10 years.

- Allocate equal amounts to each bond.

- Reinvest the proceeds when each bond matures.

Here’s an example table to illustrate:

| Bond | Maturity | Investment Amount |

|---|---|---|

| Bond A | 1 year | $1,000 |

| Bond B | 3 years | $1,000 |

| Bond C | 5 years | $1,000 |

| Bond D | 7 years | $1,000 |

| Bond E | 10 years | $1,000 |

By following these steps, you create a diversified investment strategy. This helps manage risk and ensures regular income.

Choosing The Right Bonds

Choosing the right bonds is crucial for successful bond laddering. This section helps you understand how to select the best bonds for your investment strategy.

Types Of Bonds

Bonds come in various types. Here are some common ones:

- Government Bonds: Issued by the government, these are low-risk.

- Municipal Bonds: Issued by local governments, often tax-exempt.

- Corporate Bonds: Issued by companies, these offer higher returns.

- Zero-Coupon Bonds: Sold at a discount, they pay no interest until maturity.

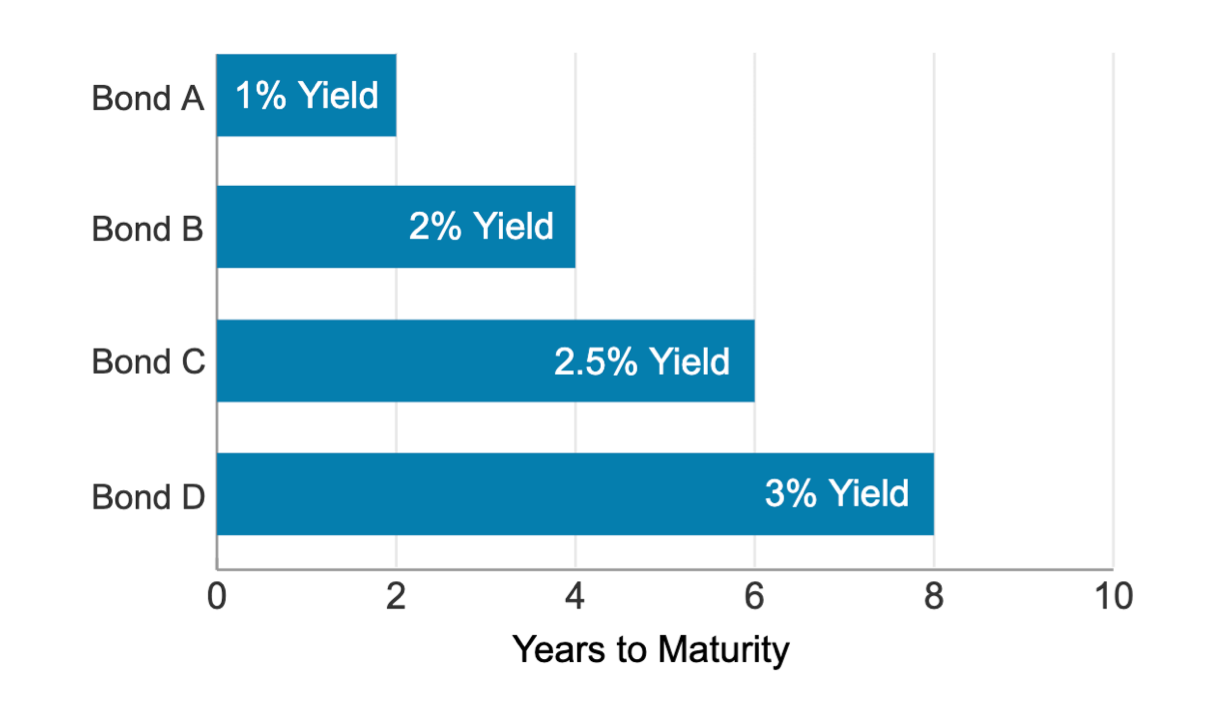

Evaluating Bond Quality

Evaluating bond quality ensures you choose the best bonds. Consider these factors:

- Credit Ratings: Look for bonds with high credit ratings.

- Yield: Check the yield to understand potential returns.

- Maturity Date: Choose bonds that fit your laddering strategy.

- Issuer’s Financial Health: Ensure the issuer is financially stable.

Here is a table summarizing key aspects to evaluate:

| Aspect | Importance |

|---|---|

| Credit Ratings | High |

| Yield | Medium |

| Maturity Date | High |

| Issuer’s Financial Health | High |

Credit: www.snideradvisors.com

Risks And Considerations

Bond laddering is a popular investment strategy. It involves buying bonds with different maturity dates. This strategy aims to reduce interest rate risk and provide steady income. But, like all investment strategies, bond laddering comes with its own set of risks and considerations.

Interest Rate Risk

Interest rate risk is a key concern in bond laddering. When interest rates rise, bond prices fall. This can reduce the value of your bond portfolio. If you need to sell a bond before it matures, you might get less than you paid for it. A bond ladder helps manage this risk. It spreads out the maturity dates of your bonds. This way, not all your bonds are affected by rate changes at the same time.

Credit Risk

Credit risk is another important factor. This is the risk that a bond issuer will default. If the issuer can’t pay interest or repay the principal, you could lose money. To mitigate credit risk, diversify your bond ladder. Include bonds from various issuers and sectors. Choose bonds with high credit ratings for added safety.

| Risk Type | Description | Mitigation Strategy |

|---|---|---|

| Interest Rate Risk | Risk of bond prices falling due to rising interest rates. | Diversify maturity dates in your bond ladder. |

| Credit Risk | Risk of bond issuer defaulting on payments. | Diversify issuers and sectors; choose high-rated bonds. |

Strategies For Effective Bond Laddering

Bond laddering helps manage investment risk and generate steady income. Using effective strategies can maximize the benefits of bond laddering. Below are some tactics to consider.

Diversification Tactics

Diversification reduces risk by spreading investments across various bonds. Invest in bonds from different issuers and sectors. This minimizes the impact if one issuer defaults.

Consider bonds with different credit ratings. A mix of high and low-rated bonds balances risk and return. This approach ensures a steady income stream.

| Issuer | Sector | Credit Rating |

|---|---|---|

| Issuer A | Energy | AAA |

| Issuer B | Technology | BBB |

| Issuer C | Healthcare | AA |

Reinvestment Strategies

Reinvesting bond proceeds is crucial for maintaining the ladder. As bonds mature, use the proceeds to buy new bonds. This keeps your ladder steady and generates continuous income.

- Reinvest in bonds with varying maturities.

- Choose bonds with interest rates matching your income goals.

- Consider market conditions before reinvesting.

Avoid reinvesting in bonds with the same maturity dates. This prevents income gaps. Ensure the ladder remains balanced and productive.

Effective bond laddering requires thoughtful reinvestment. It maximizes returns and minimizes risks.

Real-life Examples

Understanding bond laddering can be complex, but real-life examples help. These examples show how people use bond laddering in daily life. Let’s explore some case studies and success stories.

Case Studies

John is a retiree who builds a bond ladder. He buys bonds that mature every year for the next five years. John invests $50,000 in total. Here’s a breakdown of his investment:

| Bond Maturity | Investment Amount |

|---|---|

| 1 Year | $10,000 |

| 2 Years | $10,000 |

| 3 Years | $10,000 |

| 4 Years | $10,000 |

| 5 Years | $10,000 |

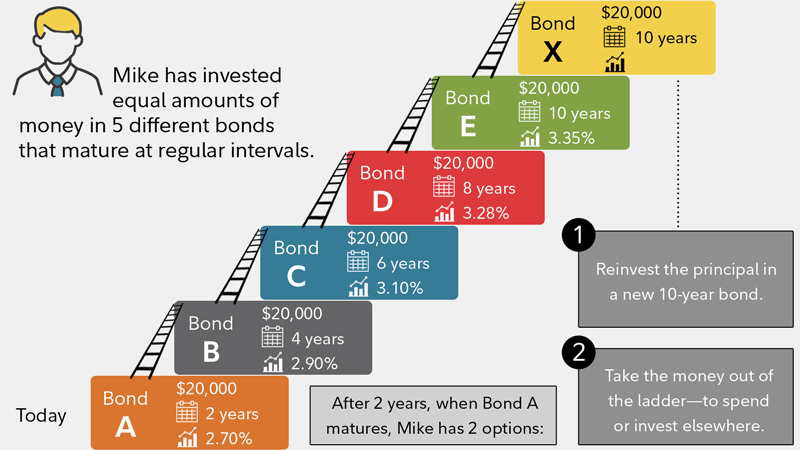

Each year, one of John’s bonds matures. He uses the returned principal to buy a new 5-year bond. This strategy provides a steady income and reduces risk.

Success Stories

Jane is a financial advisor. She helps her clients build bond ladders. One of her clients, Mike, is saving for his children’s education. Mike invests $100,000 in a bond ladder. His investment plan looks like this:

| Bond Maturity | Investment Amount |

|---|---|

| 1 Year | $20,000 |

| 2 Years | $20,000 |

| 3 Years | $20,000 |

| 4 Years | $20,000 |

| 5 Years | $20,000 |

Every year, one bond matures, and Mike reinvests in a new 5-year bond. This strategy ensures Mike has funds available when his children start college.

These case studies and success stories show how bond laddering works in real life. They highlight the benefits of this investment strategy for different goals.

Frequently Asked Questions

What Is Bond Laddering?

Bond laddering is an investment strategy. It involves purchasing bonds with different maturity dates to reduce risk.

How Does Bond Laddering Work?

Investors buy bonds maturing at different times. This creates a “ladder” effect, ensuring regular income and mitigating interest rate risk.

Why Use A Bond Ladder Strategy?

A bond ladder provides predictable income. It also reduces the risk of interest rate fluctuations affecting your investments.

What Are The Benefits Of Bond Laddering?

Bond laddering offers diversification. It provides steady income and reduces the impact of market volatility on your portfolio.

Can Bond Laddering Reduce Investment Risk?

Yes, bond laddering reduces risk. It spreads investment across various maturities, protecting against interest rate changes.

Conclusion

Bond laddering is a smart investment strategy. It offers regular income and reduces risk. This method involves buying bonds with different maturities. It helps in managing interest rate changes. Bond laddering also provides flexibility. It’s suitable for both beginners and experienced investors.

Try bond laddering to diversify and secure your investments.