CD laddering is a strategy for investing in certificates of deposit. It involves spreading investments across multiple CDs with different maturity dates.

CD laddering offers a way to manage your savings effectively. This strategy helps you benefit from higher interest rates. By spreading investments across different maturity dates, you can access funds periodically. It reduces the risk of locking all your money in one CD.

This method ensures liquidity and maximizes returns. It is suitable for those who want a steady income from their savings. Short-term CDs offer quick access to funds. Long-term CDs usually offer higher interest rates. CD laddering is a safe and practical approach to grow your savings. It provides a balance between earning interest and maintaining access to funds.

Credit: www.usaa.com

Introduction To Cd Laddering

CD Laddering is a smart way to manage your savings. It helps you earn more interest while keeping your money accessible. Let’s explore the basics and benefits of CD Laddering.

Basics Of Certificates Of Deposit

Certificates of Deposit (CDs) are savings accounts with fixed terms. They offer higher interest rates than regular savings accounts. You deposit money for a set period, known as the term. At the end of the term, you get your money back with interest.

Here are some key points about CDs:

- Fixed Interest Rate: The interest rate is fixed for the term.

- Term Length: Terms can range from a few months to several years.

- Early Withdrawal Penalty: Withdrawing early may result in penalties.

- FDIC Insured: CDs are insured by the FDIC up to $250,000.

| Term Length | Interest Rate |

|---|---|

| 6 months | 1.50% |

| 1 year | 2.00% |

| 5 years | 3.00% |

Why Choose Cd Laddering

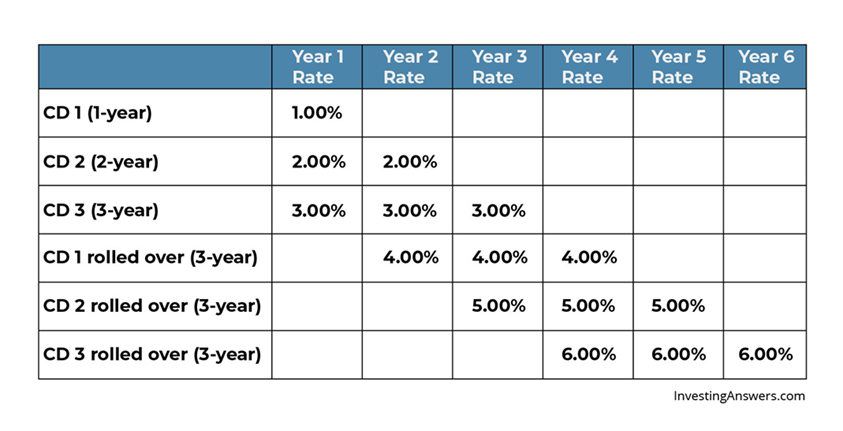

CD Laddering is a strategy to maximize your earnings. It involves dividing your investment into multiple CDs with different terms. This way, you get regular access to your money without penalties.

Here are the benefits of CD Laddering:

- Higher Interest Rates: Longer-term CDs generally offer higher rates.

- Regular Access: You can access a portion of your funds regularly.

- Reduced Risk: Diversifying your investments reduces risk.

For example, if you have $10,000 to invest, you can create a CD Ladder:

$2,000 in a 1-year CD

$2,000 in a 2-year CD

$2,000 in a 3-year CD

$2,000 in a 4-year CD

$2,000 in a 5-year CD

Each year, one CD matures. You can reinvest it in a new 5-year CD. This way, you always have a CD maturing every year, giving you regular access to your funds.

Credit: www.glcu.org

Benefits Of Cd Laddering

Certificate of Deposit (CD) Laddering offers numerous benefits. It’s a smart strategy to maximize returns while maintaining some liquidity. Let’s explore some key advantages.

Increased Liquidity

CD Laddering provides increased liquidity. You don’t need to lock all your money in one CD. Instead, you spread it across multiple CDs with different maturity dates. This way, you can access funds more frequently without penalties.

Here’s a simple example:

| CD Term | Amount |

|---|---|

| 1 Year | $1,000 |

| 2 Years | $1,000 |

| 3 Years | $1,000 |

| 4 Years | $1,000 |

| 5 Years | $1,000 |

Every year, one CD matures, providing you with liquidity. This makes your funds more accessible compared to a single long-term CD.

Enhanced Interest Rates

Another benefit is enhanced interest rates. Long-term CDs usually offer higher interest rates. With CD Laddering, you can take advantage of these better rates while still keeping some money accessible.

For instance:

- 1-Year CD: 1.5% interest

- 2-Year CD: 1.8% interest

- 3-Year CD: 2.0% interest

- 4-Year CD: 2.2% interest

- 5-Year CD: 2.5% interest

By laddering, you benefit from the higher rates of longer-term CDs. This can significantly boost your overall returns.

CD Laddering is a powerful tool. It offers liquidity and better interest rates. This makes it an attractive option for many savers.

How To Build A Cd Ladder

Building a CD ladder can be a smart way to optimize your savings. This strategy involves spreading investments across multiple Certificates of Deposit (CDs) with varying maturity dates. By following a structured approach, you can ensure a steady stream of returns while maintaining liquidity.

Choosing The Right Term Lengths

Selecting the appropriate term lengths is crucial for a successful CD ladder. Typically, you should choose CDs with different maturities, such as 1-year, 2-year, 3-year, 4-year, and 5-year terms. This diversification allows you to balance between short-term access to funds and long-term higher interest rates.

| Term Length | Reason |

|---|---|

| 1-Year | Quick access to funds |

| 2-Year | Moderate return rate |

| 3-Year | Balanced risk and return |

| 4-Year | Higher return rate |

| 5-Year | Highest return rate |

Staggering Maturity Dates

Staggering maturity dates ensures you have regular access to your funds. This method allows you to re-invest or use the money as needed. For example, if you invest in a 5-year CD ladder:

- Invest in 1-year, 2-year, 3-year, 4-year, and 5-year CDs.

- Each year, one CD matures and can be re-invested.

- Re-invest the matured CD into a new 5-year CD.

This process creates a cycle where every year, one CD matures. You can then decide to either reinvest or use the funds.

- Liquidity: Regular access to funds.

- Flexibility: Adjust investment based on financial goals.

- Higher Returns: Benefit from long-term CDs with higher rates.

- Risk Management: Reduce the risk of interest rate fluctuations.

Credit: www.sccu.com

Strategies For Effective Cd Laddering

Strategies for Effective CD Laddering can maximize your investment returns. These strategies help you balance liquidity and income. Here, we’ll discuss two key strategies: short-term vs long-term ladders and reinvesting matured CDs.

Short-term Vs Long-term Ladders

Short-term CD ladders have CDs maturing within a few months to a year. They offer more liquidity and flexibility. This strategy helps you access funds quickly. Short-term ladders work well in uncertain interest rate environments.

Long-term CD ladders have CDs maturing over several years. They generally offer higher interest rates. This approach locks in higher rates for a longer time. Long-term ladders are suitable for those who can wait for better returns.

Consider your financial goals before choosing a ladder. Balancing short-term and long-term ladders can provide both liquidity and higher returns.

Reinvesting Matured Cds

Reinvesting matured CDs is crucial for maintaining your ladder. When a CD matures, reinvest the funds into a new CD. This keeps your ladder cycle going.

Reinvesting helps you take advantage of changing interest rates. If rates increase, your new CDs will earn more. If rates decrease, your other CDs still earn higher rates.

To reinvest effectively, follow these steps:

- Monitor your CD maturity dates.

- Research current interest rates.

- Select a new CD term that fits your ladder.

- Reinvest the matured funds promptly.

By consistently reinvesting matured CDs, you ensure a continuous income stream. This strategy also helps you adapt to interest rate changes.

| Strategy | Benefits | Considerations |

|---|---|---|

| Short-term Ladder | More liquidity, flexible access | Lower interest rates |

| Long-term Ladder | Higher interest rates, long-term gains | Less liquidity |

Risks And Considerations

CD laddering is a popular investment strategy. It helps manage risks and maximize returns. But, there are some risks and considerations to keep in mind. Understanding these can help investors make better decisions.

Interest Rate Fluctuations

Interest rates can change over time. If rates rise, the returns on older CDs may seem low. This can affect your overall earnings. It is important to monitor interest rates regularly. This helps in adjusting your strategy if needed.

Early Withdrawal Penalties

Withdrawing money from a CD before its maturity can lead to penalties. These penalties can reduce your overall returns. It is important to be aware of these penalties before investing. This will help in planning your liquidity needs effectively.

Maximizing Your Cd Ladder

Creating a CD ladder is a smart strategy for managing savings. It helps you earn higher interest while maintaining liquidity. Maximizing your CD ladder ensures you get the most out of your investment. This involves monitoring market trends and making necessary adjustments.

Monitoring Market Trends

Stay informed about interest rate changes. This can help you make better decisions. Interest rates affect the returns on your CDs. Keep an eye on economic news and financial forecasts. This information is crucial for optimizing your ladder.

- Check financial news websites regularly.

- Subscribe to economic newsletters.

- Follow reputable financial analysts on social media.

Adjusting Ladder As Needed

Your CD ladder should be flexible. Adjust it based on market conditions. When rates rise, consider reinvesting in new CDs with higher returns. If rates drop, you might want to hold onto existing CDs with better rates.

| Condition | Action |

|---|---|

| Rising Rates | Reinvest in new CDs |

| Falling Rates | Hold onto current CDs |

Regularly review your CD ladder. This will help you make timely adjustments. Always aim for the best possible returns.

Frequently Asked Questions

What Is Cd Laddering?

CD laddering is a strategy to stagger certificate of deposit (CD) maturity dates.

How Does Cd Laddering Work?

CD laddering involves dividing investments into multiple CDs with different maturity dates.

What Are The Benefits Of Cd Laddering?

CD laddering provides liquidity, flexibility, and higher interest rates.

Is Cd Laddering A Safe Investment?

Yes, CD laddering is low-risk and FDIC-insured.

Who Should Consider Cd Laddering?

CD laddering suits conservative investors seeking steady returns.

Conclusion

CD laddering is a smart savings strategy. It helps manage your funds better. You can earn more interest with less risk. This method provides flexibility and financial growth. Start small and enjoy secure returns over time. CD laddering can enhance your financial stability.

Happy saving!