The CD laddering strategy involves investing in multiple Certificates of Deposit (CDs) with different maturity dates. This approach maximizes interest rates and provides liquidity at regular intervals.

CD laddering is a popular investment strategy. It helps spread risk and earn higher interest. Investors buy several CDs with staggered maturity dates. For example, one CD may mature in one year, another in two years, and so on. This way, investors can reinvest funds at higher rates if interest rates rise.

It also ensures access to funds without penalties. This strategy balances safety and returns, making it suitable for risk-averse investors. Proper planning and understanding of interest trends are key to success.

Credit: www.glcu.org

Introduction To Cd Laddering

CD Laddering is a smart investment strategy. It involves spreading money across multiple Certificates of Deposit (CDs). This helps reduce risks and maximizes returns. Investors often use this method for better liquidity and higher interest rates. Let’s dive deeper into the concept.

Concept Of Cd Laddering

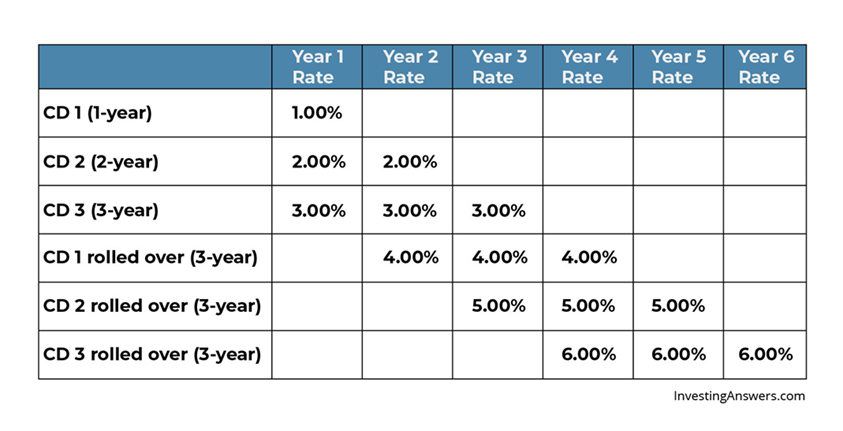

CD Laddering involves buying several CDs with different maturity dates. Here’s a simple example:

| Amount | Term | Interest Rate |

|---|---|---|

| $1,000 | 1 Year | 2% |

| $1,000 | 2 Years | 2.5% |

| $1,000 | 3 Years | 3% |

Here, you invest $1,000 in three CDs. Each CD has different terms and interest rates. This ensures you always have a CD maturing soon.

Benefits Of Cd Laddering

- Higher Returns: Longer-term CDs often have higher interest rates.

- Reduced Risk: Diversification helps minimize risks.

- Liquidity: Regular access to funds as CDs mature at different times.

CD Laddering offers a balanced approach to investing. It combines safety, liquidity, and higher returns.

How Cd Laddering Works

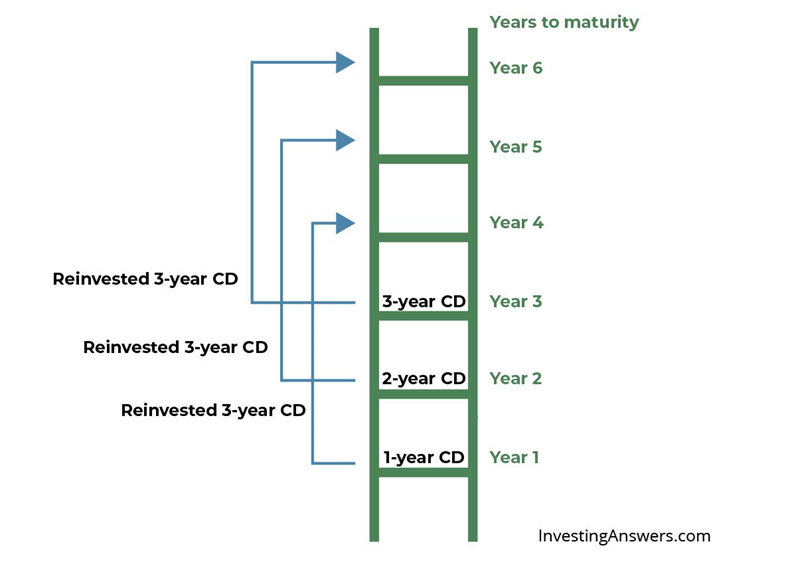

CD Laddering is a smart way to grow your savings. This strategy involves dividing your investment into multiple CDs with different maturity dates. This method helps to balance the interest rate risk and liquidity.

Setting Up A Cd Ladder

To start a CD ladder, you need to decide on the total amount you want to invest. Then, you split this amount into equal parts. Each part is placed into a separate CD with different maturity dates. This way, you have CDs maturing at regular intervals, providing you with regular access to your funds.

| Investment Amount | CD Term | Interest Rate |

|---|---|---|

| $1,000 | 1 Year | 2.00% |

| $1,000 | 2 Years | 2.50% |

| $1,000 | 3 Years | 3.00% |

Step-by-step Process

- Decide on your total investment amount. Divide this amount into equal parts.

- Choose different CD terms. Select CDs with staggered maturity dates, such as 1 year, 2 years, and 3 years.

- Invest in the CDs. Place each part of your investment in the chosen CDs.

- Reinvest the matured CDs. When a CD matures, reinvest it into a new long-term CD to continue the ladder.

By following these steps, you ensure regular access to your funds. This way, you benefit from higher interest rates on longer-term CDs. CD Laddering is a great strategy to manage your savings efficiently.

Advantages Of Cd Laddering

The CD Laddering Strategy offers several key advantages for investors. This approach involves splitting a lump sum into multiple certificates of deposit (CDs) with different maturity dates. By doing so, investors can enjoy various benefits such as higher interest rates and reduced risk.

Higher Interest Rates

One of the main advantages of CD laddering is the potential for higher interest rates. By investing in CDs with different maturity dates, you can take advantage of rising interest rates over time. When a CD matures, you can reinvest the funds into a new CD with a higher rate. This ensures that your investments grow steadily.

Here’s how it works:

- Divide your initial investment into equal parts.

- Invest each part in CDs with different terms (e.g., 1 year, 2 years, 3 years).

- As each CD matures, reinvest the funds into a new CD with a higher rate.

This strategy helps you maximize your returns while keeping some funds available for future reinvestment.

Reduced Risk

CD laddering also offers reduced risk compared to investing all your money in a single CD. By spreading your investment across multiple CDs with different maturity dates, you minimize the impact of interest rate fluctuations. If rates drop, only a portion of your investment is affected. This diversification helps protect your overall portfolio.

Other benefits include:

- Consistent access to funds as CDs mature at different times.

- Flexibility to adjust your strategy based on current interest rates.

- Lower risk of losing out on better rates.

By using the CD laddering strategy, you can enjoy a balanced approach to investing. This method helps you achieve higher returns while managing your risk effectively.

Credit: www.glcu.org

Types Of Cds

Understanding the different types of CDs is essential for a successful CD laddering strategy. CDs, or Certificates of Deposit, come in various forms, each with unique features and benefits. Below, we explore two popular types of CDs: Traditional CDs and No-Penalty CDs.

Traditional Cds

Traditional CDs offer fixed interest rates for a specific term. The term can range from a few months to several years. During this period, the interest rate remains constant. This ensures a predictable return on investment. Traditional CDs typically offer higher interest rates than regular savings accounts. They are an excellent option for those who do not need immediate access to their funds.

Here’s a quick overview of Traditional CDs:

- Fixed interest rates

- Specified term lengths

- Higher interest rates than savings accounts

- Penalties for early withdrawal

No-penalty Cds

No-Penalty CDs allow early withdrawal without incurring penalties. This flexibility makes them attractive for investors who might need access to their funds. While the interest rates are generally lower than Traditional CDs, the benefit of no penalties can outweigh this. No-Penalty CDs are ideal for those seeking a balance between earning interest and maintaining liquidity.

Key features of No-Penalty CDs include:

- Early withdrawal without penalties

- Lower interest rates than Traditional CDs

- Flexibility in accessing funds

- Shorter and more flexible terms

Maximizing Savings With Cd Laddering

CD laddering is a smart way to save money. It helps you get the best interest rates. This strategy involves splitting your money into multiple Certificates of Deposit (CDs) with different maturity dates. The goal is to have consistent access to your funds while earning higher interest rates. Let’s explore how to maximize savings with CD laddering.

Optimal Ladder Lengths

Choosing the right ladder length is crucial. Here are some common ladder lengths:

| Ladder Length | Description |

|---|---|

| 1-Year Ladder | CDs mature every 3 months. |

| 2-Year Ladder | CDs mature every 6 months. |

| 5-Year Ladder | CDs mature annually. |

A 1-year ladder offers frequent access to funds. A 5-year ladder provides higher interest rates. Choose based on your financial goals.

Reinvesting Strategies

Reinvesting your matured CDs is key. Here are some strategies:

- Reinvest in a new CD with a longer term for higher interest rates.

- Use the matured CD funds to cover short-term financial needs.

- Combine matured CDs to create a new ladder with different terms.

Reinvesting helps you continue earning interest. It also keeps your savings strategy flexible.

Common Mistakes To Avoid

Using a CD Laddering Strategy can be very useful. But, many investors make common mistakes. Avoiding these mistakes can help you maximize your returns.

Ignoring Interest Rate Trends

Interest rate trends are very important. Not paying attention to them can be costly. Here are some points to consider:

- Interest rates fluctuate. They can go up or down.

- Research current trends. Use this information for better decisions.

- Adjust your strategy based on these trends.

Ignoring these trends can lead to lower returns. Always stay informed about interest rates.

Not Diversifying

Diversification is key in investing. Relying on one strategy can be risky. Here are some tips:

- Spread your investments across different CDs.

- Consider CDs with varying maturity dates.

- Include different financial institutions in your plan.

Diversification reduces risks and increases potential returns. Make sure your CD ladder is well-diversified.

| Mistake | Impact | Solution |

|---|---|---|

| Ignoring Interest Rate Trends | Lower Returns | Stay Informed |

| Not Diversifying | Increased Risk | Spread Investments |

Credit: www.usaa.com

Frequently Asked Questions

What Is Cd Laddering Strategy?

CD laddering strategy involves investing in multiple certificates of deposit with different maturity dates to optimize returns and liquidity.

How Does Cd Laddering Work?

It spreads investments across various CDs with staggered maturity dates, providing periodic access to funds and better interest rates.

Benefits Of Cd Laddering Strategy?

It offers higher interest rates, reduces reinvestment risk, and provides regular access to funds without penalties.

Who Should Use Cd Laddering?

Investors seeking steady returns, low risk, and periodic access to their funds should consider CD laddering strategy.

Can Cd Laddering Maximize Returns?

Yes, it can maximize returns by taking advantage of higher interest rates on longer-term CDs while maintaining liquidity.

Conclusion

A CD laddering strategy offers balanced returns and easy access to funds. This method helps diversify investments and reduce risks. It’s a smart way to manage savings. Start small, and watch your investments grow steadily. Consider CD laddering for a secure financial future.

Explore its benefits today.