FD laddering is a strategic way to manage fixed deposits. It involves splitting investments across multiple FDs with different maturities.

This strategy helps balance liquidity and returns. Understanding FD laddering can enhance your financial planning. It allows you to access funds periodically while earning higher interest rates on long-term deposits. Instead of locking all your money in a single fixed deposit, you can spread it across various terms.

This not only mitigates the risk of interest rate fluctuations but also ensures better cash flow management. In this blog post, we’ll explore the concept of FD laddering, its benefits, and how you can implement it in your investment strategy. Dive in to learn how FD laddering can optimize your savings and provide financial stability.

Credit: www.etmoney.com

Introduction To Fd Laddering

FD Laddering is a strategy used to manage fixed deposits (FDs) effectively. It involves spreading your investment across multiple FDs with different maturity dates. This approach helps to balance liquidity and returns.

Concept Overview

The FD Laddering strategy divides your total investment into equal parts. Each part is invested in a fixed deposit with a different term. For example, if you have $10,000, you could invest $2,000 each in FDs maturing in 1, 2, 3, 4, and 5 years.

| Investment Amount | Maturity Period |

|---|---|

| $2,000 | 1 year |

| $2,000 | 2 years |

| $2,000 | 3 years |

| $2,000 | 4 years |

| $2,000 | 5 years |

As each FD matures, you can reinvest it in a new long-term FD. This way, you always have one FD maturing every year, providing regular access to funds.

Importance Of Fd Laddering

FD Laddering offers several benefits:

- Improved Liquidity: Access to funds regularly without breaking long-term FDs.

- Risk Management: Reduces the risk of interest rate fluctuations.

- Consistent Returns: Balances high returns from long-term FDs with liquidity from short-term FDs.

This strategy is especially useful for those who rely on FDs for regular income. It ensures a steady flow of funds while maximizing returns.

Credit: m.youtube.com

How Fd Laddering Works

Fixed Deposit (FD) Laddering is a smart investment strategy. It allows you to manage your funds efficiently while maximizing returns. Understanding how FD Laddering works can help you make the most of your investments.

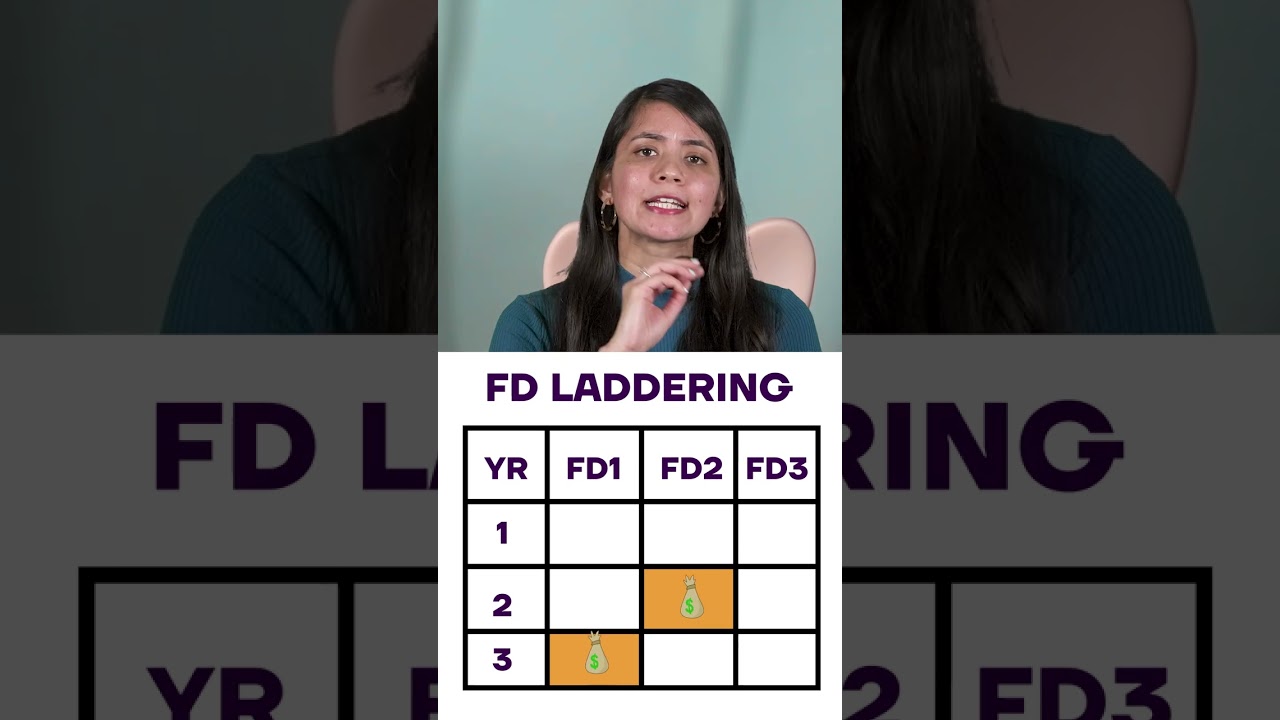

Step-by-step Process

Follow these steps to create an FD Ladder:

- Divide your investment amount: Split your total investment into equal parts.

- Choose different tenures: Invest each part in FDs with different maturity dates.

- Reinvest at maturity: When an FD matures, reinvest it in a new FD with a longer tenure.

Illustrative Example

Let’s understand FD Laddering with an example:

| Investment Amount | Maturity Period | Interest Rate |

|---|---|---|

| $1,000 | 1 Year | 5% |

| $1,000 | 2 Years | 5.5% |

| $1,000 | 3 Years | 6% |

With this strategy:

- After 1 year, the first FD matures. Reinvest it for 3 years at a higher interest rate.

- After 2 years, the second FD matures. Reinvest it for another 3 years.

- After 3 years, the last FD matures. Reinvest it for another 3 years.

This way, you always have an FD maturing every year. This ensures liquidity and maximizes returns.

Benefits Of Fd Laddering

FD laddering is a smart investment strategy. It involves splitting investments into multiple fixed deposits (FDs) with different maturity dates. This strategy offers several benefits, including better liquidity management, risk mitigation, and higher returns.

Liquidity Management

One of the key benefits of FD laddering is liquidity management. By having FDs maturing at different times, you can access funds when needed. This avoids the need to break an FD and incur penalties.

For instance:

| FD Amount | Maturity Period |

|---|---|

| $5,000 | 1 Year |

| $5,000 | 2 Years |

| $5,000 | 3 Years |

This table shows how your money gets distributed. You will have an FD maturing each year. This ensures you have funds available regularly.

Risk Mitigation

FD laddering helps in risk mitigation. It reduces the impact of interest rate changes over time. If interest rates rise, only a part of your investment is affected. You can reinvest maturing FDs at higher rates.

Consider this scenario:

- Interest rates increase after one year.

- Your 1-year FD matures.

- Reinvest at the new, higher rate.

This reduces the overall risk and increases potential returns.

FD laddering is a beneficial strategy. It offers liquidity management and risk mitigation. It helps in better financial planning and ensures a steady flow of funds.

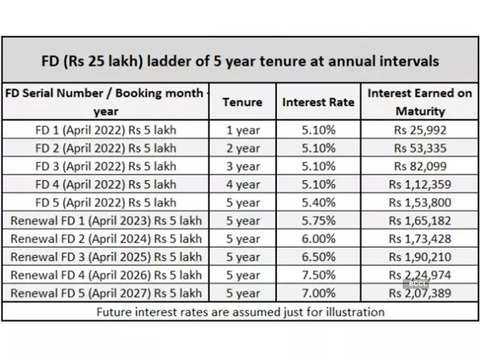

Credit: m.economictimes.com

Strategies For Effective Fd Laddering

Implementing the right strategies for effective FD laddering can maximize returns. It involves the systematic process of investing in fixed deposits with different maturities. This strategy reduces risks and ensures liquidity. Below are essential strategies to make FD laddering work for you.

Diversification Tips

Diversifying your FDs is crucial. It means splitting your investment across multiple FDs with different banks and tenures. This spreads the risk and increases your chances of getting better interest rates.

- Choose different banks: Don’t put all your money in one bank.

- Vary the tenures: Invest in FDs with short-term, medium-term, and long-term durations.

- Interest rate comparison: Compare rates from various banks before investing.

Timely Reinvestment

Reinvesting your FDs on time is vital. It ensures that your money continues to grow without any breaks. Here’s how to manage timely reinvestment effectively:

- Set reminders: Use calendar alerts to remind you of maturity dates.

- Auto-renewal option: Opt for auto-renewal if available, to avoid manual reinvestment.

- Monitor interest rates: Check current rates before reinvesting to get the best returns.

| Bank | Interest Rate | Tenure |

|---|---|---|

| Bank A | 5.5% | 1 Year |

| Bank B | 6.0% | 2 Years |

| Bank C | 6.5% | 5 Years |

By following these strategies, you can make the most of your FD laddering investments. It ensures steady returns and minimizes risk.

Common Mistakes To Avoid

FD laddering can help diversify investments and manage risks. But it’s important to avoid common mistakes. These mistakes can reduce the benefits of FD laddering.

Ignoring Interest Rates

Interest rates impact your returns. Always compare rates from different banks. Some banks may offer higher rates. Others may have better terms. Failing to compare can lead to lower returns.

It’s also essential to monitor changes in interest rates. Rates can change over time. Keeping an eye on trends can help you reinvest at the best rates. Locking in a rate without research can be costly.

Overlooking Tenure

The tenure of each FD is crucial. A mix of short, medium, and long-term FDs is ideal. This mix provides liquidity and higher returns. Focusing only on long-term FDs can limit access to funds. Similarly, short-term FDs may offer lower returns.

Consider your financial goals. Match the tenure of FDs to your needs. For example, plan for emergencies with short-term FDs. Use long-term FDs for future expenses. This ensures a balanced and effective FD laddering strategy.

Frequently Asked Questions

What Is Fd Laddering?

FD laddering is a strategy. It involves spreading investments across multiple fixed deposits with different maturity dates.

How Does Fd Laddering Work?

FD laddering works by dividing your investment. You invest in multiple FDs with staggered maturity dates for better liquidity.

What Are The Benefits Of Fd Laddering?

FD laddering provides benefits like better liquidity, reduced interest rate risk, and the ability to reinvest at higher rates.

Is Fd Laddering Suitable For Everyone?

FD laddering is suitable for those seeking stable returns and better liquidity. It’s ideal for conservative investors.

Can Fd Laddering Help With Interest Rate Fluctuations?

Yes, FD laddering can help. It spreads your investment, mitigating the impact of fluctuating interest rates.

Conclusion

Fd laddering offers a smart way to manage your savings. It reduces risks and maximizes returns. You can enjoy flexibility with your investments. This method helps in better financial planning. Save wisely and make your money work for you. Try Fd laddering today for a secure future.

Recent Posts

Maintaining clean gutters is essential for preventing water damage to your home, and choosing the best ladder for cleaning gutters can make the job much easier and safer. With so many options on the...

Best Ladder for Cleaning Caravan Roof: Top Picks for You Every Adventure!

Today we will discuss the best ladder for cleaning caravan roof. Cleaning caravan roofs is one of the crucial tasks.After many days, a caravan roof can get dirty by debris, dirt, and grime. These can...